Armin Alispahic is a team leader for Acadia’s retail marketplace services.

For brands, there’s always a new program that Amazon’s Vendor Managers and Advertising Account Executives want to sell you on. They promise to solve a problem, boost sales or revolutionize your business – but they come at a cost. Some programs may run up to hundreds of thousands or even millions of dollars to bring on board. So which ones are worth it, and which ones are a waste of time and money?

We polled our team of Amazon experts to share their point of view and some client perspectives.

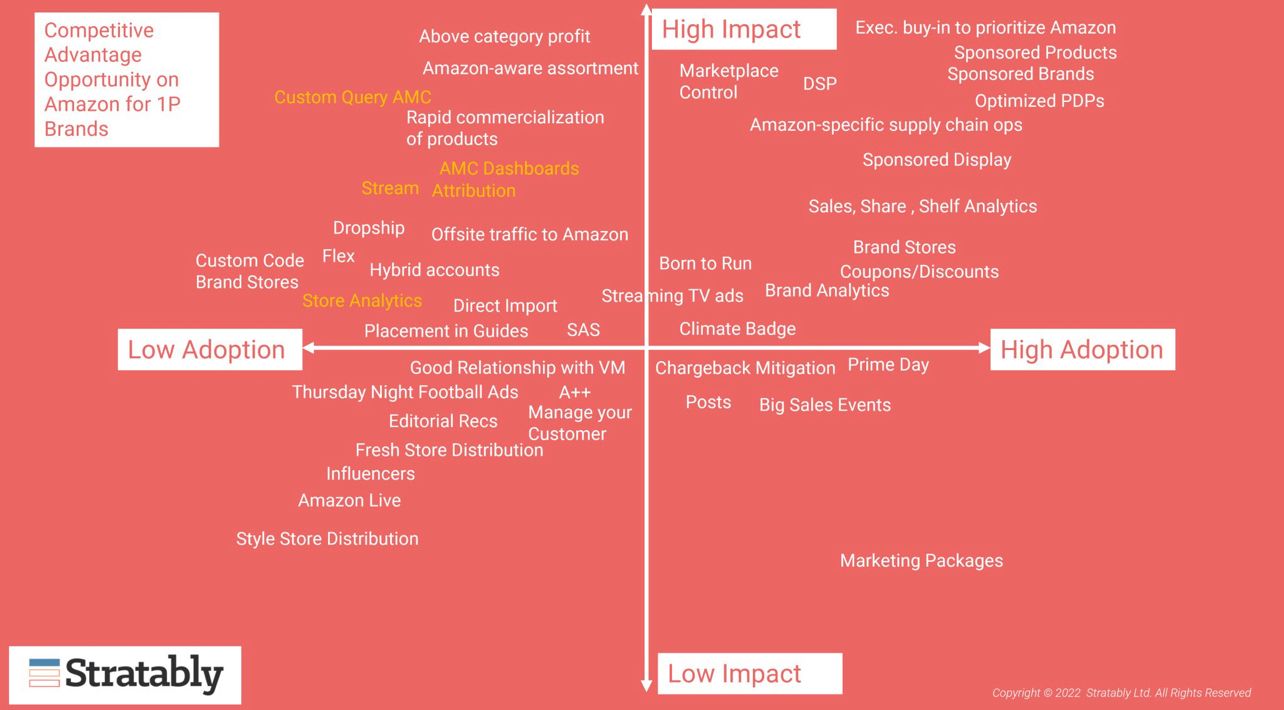

Source: Stratably.com

Is the Amazon Fashion Guide worth it for Vendors?

The pitch from Amazon: Appear in product catalogs, like the Amazon Fashion Guide or Toy Guide, to get exposure. When you sign up – and pay up – you get your product placed into Amazon’s annual mailer catalogs, as well as its digital guide pages.

So what does that placement get you, and how much does it cost? In 2022, one brand client spent $250,000 to have a product featured in the Amazon Fashion Guide, plus an additional $200,000 to have a few products listed in the Amazon Toy Guide.

The problem: one toy was later dropped from the catalog, but the client wasn’t told by the Vendor Manager. The client spent time and resources ramping up production for the item in order to have enough inventory in stock to meet the demand generated by the Toy Guide. Over in the Fashion Guide, Amazon didn’t place product orders for all variations of the apparel item that was to be listed – and on top of that, the client wasn’t happy with how the product was ultimately merchandised in the guide.

For the money spent, that’s less than an ideal result. The real clincher is the lack of data that comes back to the brand about how their product performed in the catalogs. Amazon only shares the number of households that the catalogs were mailed to (in 2021, this was 30 million for the toy catalog and 10 million for the fashion catalog). Brands have essentially no information to use to follow up their spend on leads, interest or otherwise. This is a far cry from the detailed analytics that a paid media campaign could provide.

Amazon Live

The pitch from Amazon: Get your product featured in Live video, Amazon’s fastest-growing marketing channel. Live video is the future of shopping!

The problem: One client in the beauty and personal care category spent big on a Live video placement produced by Amazon during Prime Day 2022. The video did get a prime feature, but the brand received no data around performance of the campaign. Instead, they were asked to front investment for a BF/CM live video campaign before Amazon would share performance data from the previous event, meaning more spend.

Live video has a short shelf-life, so it’s not the best investment as a marketer. Plus, other organic marketing efforts have more of a halo effect for lasting results. And it’s not an even playing field: certain brands and products will get much better results from Live video than others, meaning it’s not a fits-all strategy. James Thompson, the SVP of e-commerce and growth at Nutrabolt – the parent company of C4 Energy – joined Acadia’s Ecommerce Braintrust podcast to discuss the brand’s approach to Amazon Live and what made it very successful for the C4 brand in 2022. To summarize: they don’t just show up and shoot, they put a lot of PR and marketing effort behind the campaign too. There’s a lot of additional investment that goes into the placement to make sure it’s a success.

Our recommendation to many clients considering video is to divert that ad spend to TikTok, where we are seeing much better performance, whether it’s through advertising or influencer partnerships.

A+ Premium Content

The pitch from Amazon: A+ Premium Content is the best way to give life to your product page by adding engaging modules including additional imagery, video, and information for customers. There are 16 A+ modules to choose from, including seven content slots, video options and comparison charts. These are a must-have for brands who want to stand out from the competition by making the argument for their product right when customers are thinking about buying.

The problem: Many vendors are told conflicting information about how much Premium A+ content costs. We have seen in private vendor support forums anywhere from the following:

- Premium A+ content will cost $500,000

- In order to use Premium A+ you must also be enrolled in Amazon Vendor Services.

The reality is, it’s all a negotiation – there's no true fixed cost. Third party sellers may get the majority of the same modules for much less, around $100. And you can unlock some aspects of A+ Premium for free if you leverage the Brand Story content feature.

Is this feature worth it? If your products require a lot of storytelling, and sell at a high enough volume to justify amortizing the cost out, maybe. And now that sellers have access to much of the same Premium A+ content modules, this level of content could quickly become table-stakes for brands.

Hybrid accounts

The pitch from Amazon: Hybrid accounts, while not an Amazon program per se, are one of the top ways brands can get a competitive advantage over other 1P sellers on Amazon. The hybrid model is when one brand has two accounts on Amazon: both as a Seller and as a Vendor. This model lets brands reap the benefits of both sides of the Amazon platform.

We’ve written about these extensively here and here but here are some main points relevant to 2023:

- Now, more than ever, profitability has become the main focus for both Amazon and its vendors (and sellers for that matter).

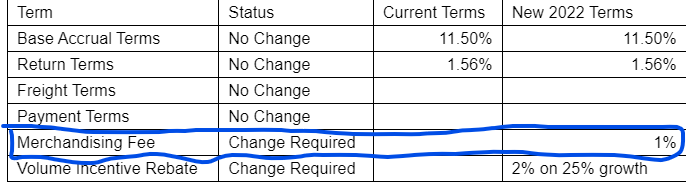

- This means Amazon will try to get even more increase in the fees during the Amazon Vendor negotiations, during which brands discuss their terms and what percentage of their shipped cost of goods sold gets funneled back to Amazon.

- For many vendors, increases of even 2 to 3% can mean specific items become unprofitable to sell.

- Typical vendor reaction is to increase product cost to Amazon to make up for the percentage increase – but more often than not, the answer from Amazon is no.

- These conversations with Amazon can go on for months and in many situations an agreement is not reached.

- Another reason brands might be interested in having a seller account is that Amazon charges Vendors for A+ content, data, and other marketing capabilities that Sellers get for free.

- The easiest and fastest way for most Vendors is to transition unprofitable items to a 3P selling model where they can control and optimize their pricing to allow for healthy margins.

- But be careful: There are implications to the relationship with Amazon, inventory availability, and more. Each situation is different. Reach out to us if you’re in this situation and we can share the trends we’re seeing.

Born to Run

The pitch from Amazon: Born to Run, or vendor-initiated orders, is a program that allows vendors to request orders for a product by telling Amazon how many units they expect to sell in 10 weeks. At its core, it brings the benefits of 3P accounts to vendors. In a 3P model, sellers are the ones deciding how many units they ship to FBA (with limitations).

This is a very low-effort tool vendors can use to highly impact their account’s performance. Select lucky vendors won’t need to use this tool ever because Amazon orders come in regularly and their products are never out of stock. If that’s not you, the best way to mitigate the risk of going out of stock in a 1P model is by opting in to the Born to Run program.

The problem: Here, there’s not so much a problem – just things to be aware of. Amazon’s algorithm is far from perfect, and vendors need to keep a close eye on their inventory health if they want to avoid losing momentum on the platform. Proper forecasting that does not rely only on Amazon numbers is essential to achieving consistent growth. The tool also comes in very handy when brands are running special events and campaigns, expecting higher traffic than what Amazon usually predicts.

The biggest mistake vendors make when it comes to the Born to Run Program is simply not knowing it exists – they either never got added to the program or they never spotted it in their account.

As with everything else on Amazon, Born to Run has its flaws. It’s not always available – some products get rejected for no clear reason – but the effort to use it is low compared to the benefits vendors can get from it.

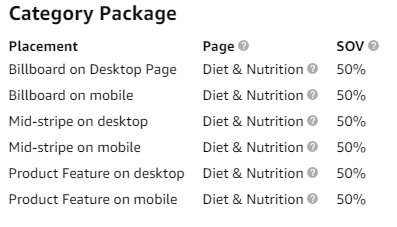

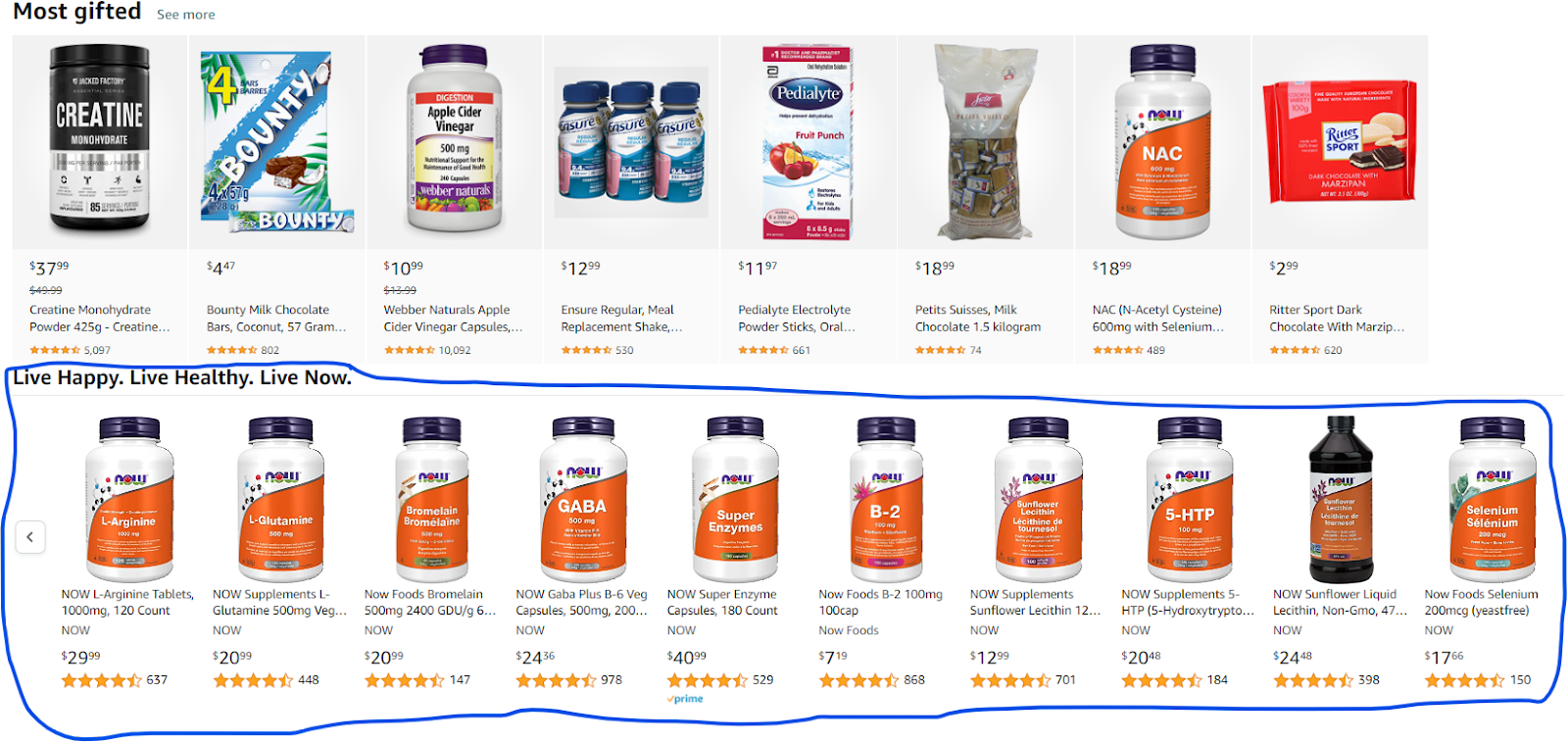

Marketing Package

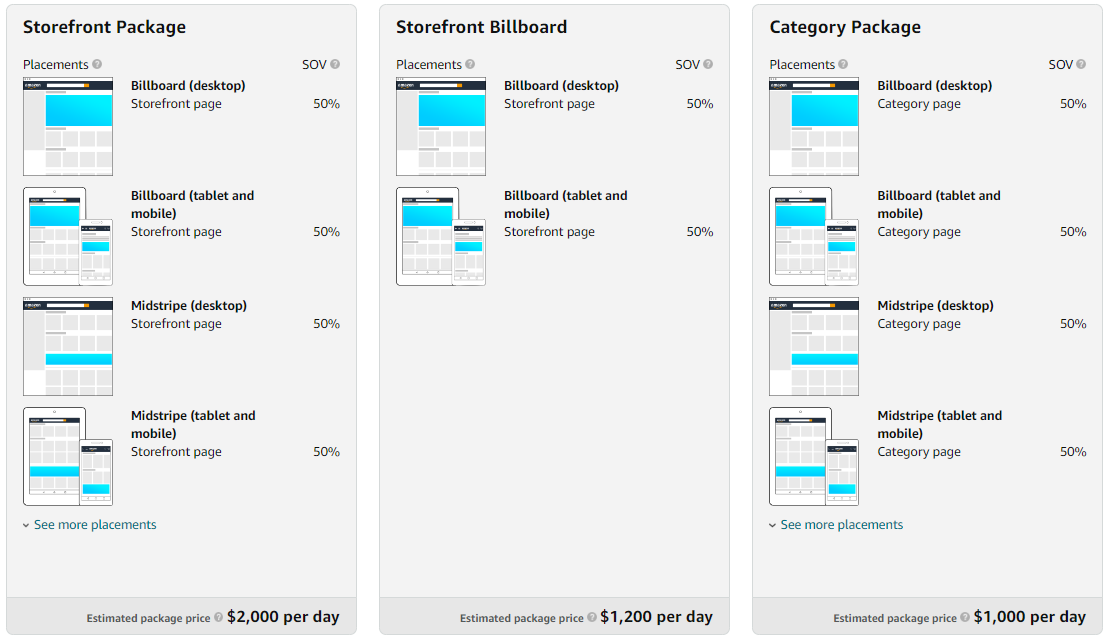

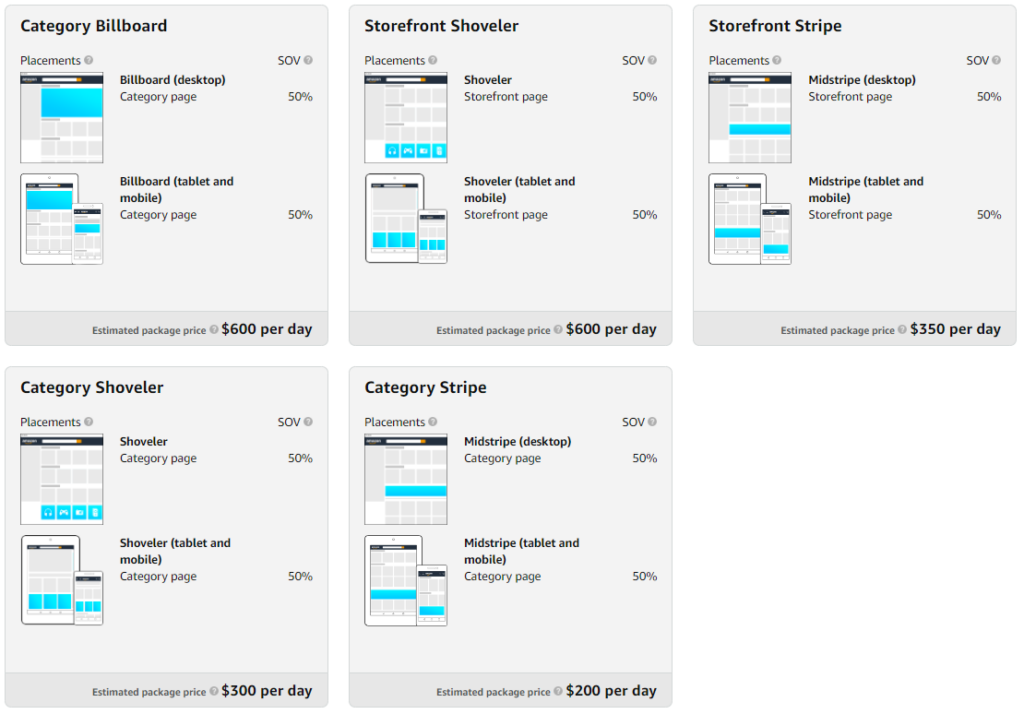

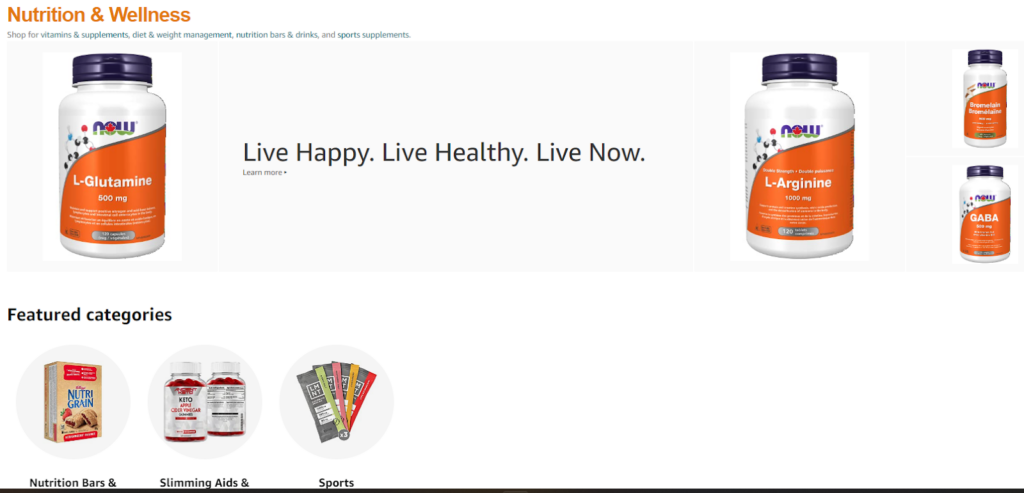

The pitch from Amazon: It’s not ads, it’s visibility – and brands are in control of how they show up. Marketing packages allow brands to appear on the Amazon homepage in banner displays, on category pages as full “shelves” of products, or in storefront billboards. There are different combinations of options and available display space, but across them all, the win for brands is to get exposure on parts of the Amazon site that can cost up to millions in ad spend and are usually the territory of only the biggest brands that sell on the platform. It’s not free – it costs about 1% of marketing budgets – but the rates are much lower than what regular ad placements would cost.

Amazon Vendor Managers are offering these marketing packages as perks to vendors. For now, it’s invite-only, and the appeal to brands is its flexibility. Brands can do a pop-up run for one day, to push a particular product for instance, or 30 days in the lead up to a big sales event like Halloween. Brands also get more control over the output. It’s largely a self-serve programme, and the brand chooses everything from the creative to what items to promote. That’s more transparency than most other Vendor marketing programs. The displays take the customer to landing pages, which the brands have also built themselves, selecting what products they want to include and what type of deal they want to run.

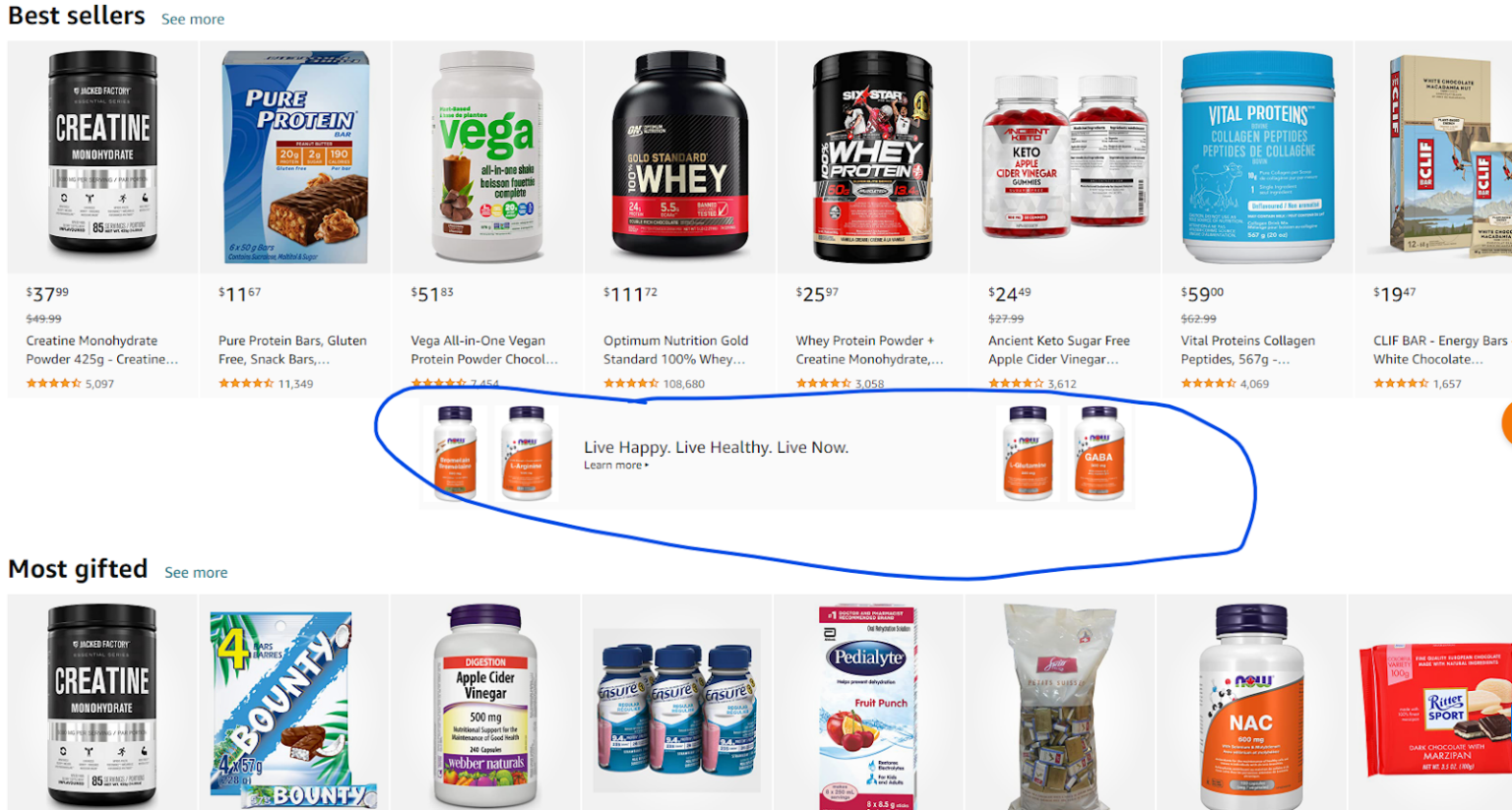

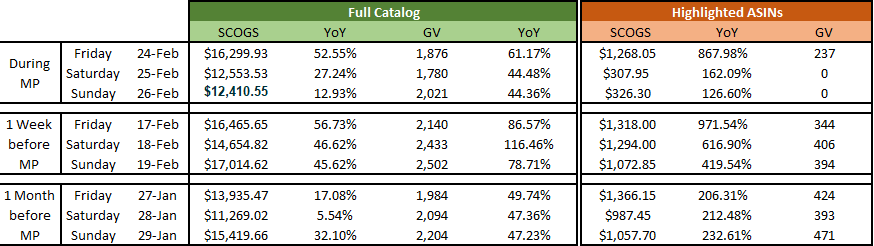

So what’s not to like? Well, it’s not clear yet how effective these displays are. One Acadia client recently tested marketing package displays after getting access to the program via their Amazon Vendor negotiations last year. We decided to go with the Category Package, which puts displays across the category page. The results have been underwhelming so far, and we are actually behind our own results for the weekend before the package, as well as the last weekend of January. The pace has slowed year over year for the same days in 2023 when the category spots were live. A few factors might be at play here, including the lack of traffic that actually goes to Amazon’s category pages – most users start at the search bar or homepage.

Still, these packages can be helpful because brands can experiment and play with them. Timing, products available and other marketing efforts happening at the same time are all factors, and because of the low-risk nature, brands can keep trying different combinations of display and formats to see what works best. Running these packages in tandem with other efforts can help boost the results as well.

Options For the “Health and Personal Care” Category:

We went with the Category Package for this first test:

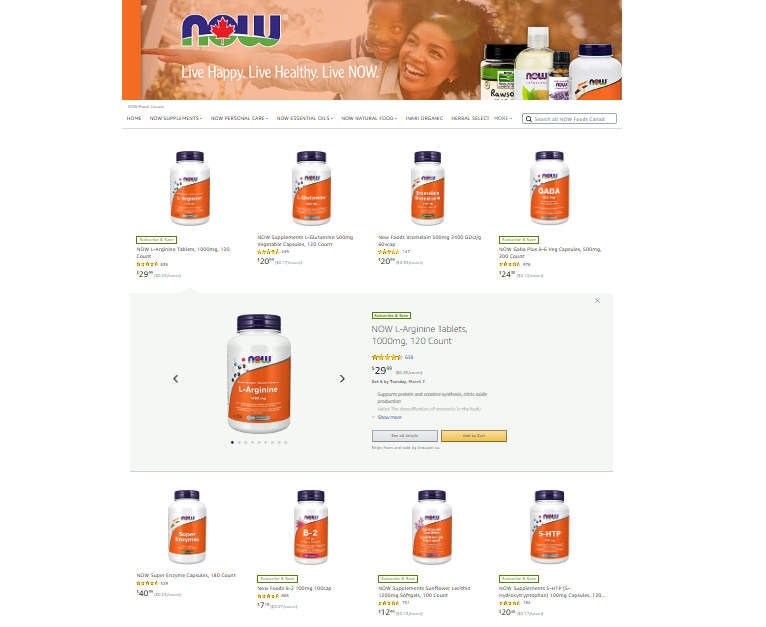

Different Placements on the Category Page:

1. Billboard - Top of Page

2. Mid-stripe

3. Product Feature

Our verdict

In many cases, brands are best served by running their own advertising and marketing campaigns. Advertising campaigns provide more data and insight on performance, as well as more control.

Control is key. With many of these Amazon programs, brands have to hand over the keys. That means Amazon is making the calls. They may not place sufficient POs to meet demand; your Vendor Manager may not share important updates with you; your product may not be merchandised how you’d like it in a catalog or in a live video demo.

Organic marketing efforts like enhancing PDPs and stores is also a better investment. Optimizing your brand for search or conversion is an investment that will pay off over a long time.

At Acadia, we help brands navigate their Amazon vendor relationship, as well as developing product and brand content, and managing Amazon advertising. Learn more about our retail media & marketplaces capabilities.