Amazon’s new Swedish and Dutch marketplaces indicate Amazon’s commitment to international expansion over the long term. Should you jump in right away? Or wait until the channels pick up steam?

In a recent episode of the Ecommerce Braintrust podcast, Bobsled CEO Kiri Masters spoke with Hendrik Laubscher, the Founder and Chief Analyst of Blue Cape Ventures about the Amazon Sweden and Netherlands opportunity.

Read on for the key takeaways.

Amazon Sweden

- Sweden has traditionally been a ‘closed’ market, hasn’t allowed foreign brands to enter, not straightforward for Swedish consumers to buy products from other Amazon EU marketplaces.

- This meant local brands have long enjoyed a stranglehold of market share.

- At the same time, Swedish consumers are probably very excited about the prospect of being able to acquire products from non-Swedish brands through the local Amazon marketplace.

Verdict: Amazon Sweden will be a hard market to crack for new players. Prepare for a hard slog – but the long term benefit of being an early adopter could be massive. If you’re able to break even after 12 months, consider your launch a big success.

Amazon Netherlands

- The Netherlands is one of the most developed markets in the world, ripe for ecommerce-focused brands.

- Unlike Sweden, Dutch consumers have been purchasing products on Amazon for a while – orders have been getting shipped from either France or Germany.

- So although the consumer behaviour has been established, new entrants will be going up against entrenched brands that intimately understand the Dutch consumer.

Verdict: Amazon Netherlands presents a fantastic opportunity given the sophistication of the market, but only for brands with deep pockets in terms of marketing investment, at least initially. Based on Henrik’s experience, he recommends that emerging brands shoot for 5-20% profitability over the first year.

Listen to the podcast episode to learn more – The Viability of Expanding to New Amazon Markets

What’s the size of the Amazon Sweden & Netherlands opportunity?

This question can be placed in the ‘how long’s a piece of string?’ basket due to the unique complexity of each potential launch! However, there are a useful few data points you can look at.

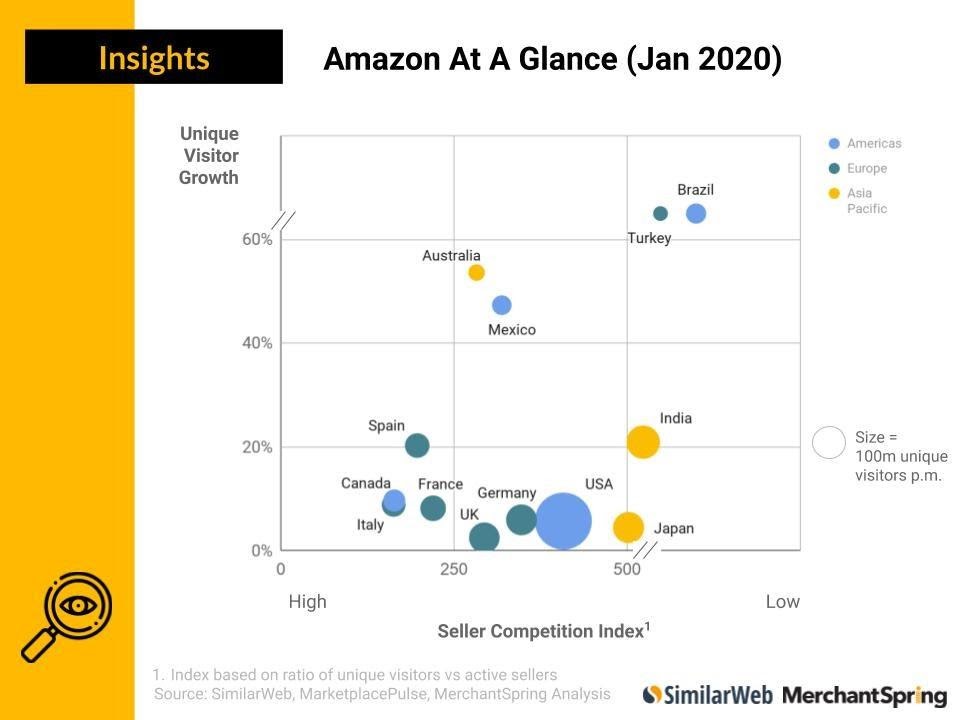

Would you rather expand to a fast-growing market, or a large one? The below chart from Similar Web / Merchant Spring illustrates which Amazon marketplaces sit on a X/Y chart of these metrics.

Source: Similar Web / Merchant Spring

Amazon Sweden and Netherlands are obviously going to be comparatively low on competition upon launch. If you’re already selling across a multitude of marketplaces, the above graph may be useful in terms of ascertaining your brand’s ‘sweet spot’ when it comes to aligning growth opportunities with market share and profitability. Bear in mind this graph was from Jan 2020, and so Covid may have drastically changed the landscape for your brand.

The Bobsled team has also provided some ballpark aggregates of total market size compared to Amazon.com:

- Canada is approx 5-10% of Amazon.com sales volume

- UK is approx 10% of Amazon.com sales volume

- EU (combined France, Italy, Germany and Spain markets) is approx 10% of Amazon.com sales volume

- Australia is approx 1% of Amazon.com sales volume

Therefore it would be safe to say that over the first year brands shouldn’t expect more than 1-5% of total sales volume compared to Amazon.com sales volume on Amazon Sweden or Netherlands. The obvious exception would be brands that already have a strong presence in these countries.

Henrik encourages brands to look at some macro metrics when it comes to gauging the Swedish and Dutch opportunity.

“GDP is a good indicator of potential,” he says. “If you establish an idea of the market as a whole, from there you can zero in on more targeted consumer research.”

Kiri encourages brands to keep Amazon’s ‘soft launch’ expansion strategy top of mind when it comes to appraising new marketplaces.

“With Amazon Australia, there was no Prime or PPC advertising on the marketplace for the first six months,” she says. “Therefore, things didn’t start with a bang. Amazon wants to win market share from other retailers slowly over time. If a brand’s going to invest in launching on Amazon Sweden and Netherlands, they should prepare for things to take a while to get going, and focus on becoming properly entrenched over the long term.”

Bobsled has deep expertise launching brands internationally – check out one of our case studies.

How Do I Launch on Amazon Sweden & Netherlands?

We have a comprehensive past blog post entitled Go Big From Home – A Breakdown Of Amazon Global & FBA Export which explains the international launch process in detail. If you’re planning to launch on a non-local Amazon marketplace soon, we’d strongly recommend reading this article in full.

But here are a few condensed points in relation to Amazon Sweden & Netherlands:

- Which Fulfillment Method? Where you store your inventory and how orders are fulfilled can have an impact on your European tax obligations, so it’s something you should be considering from the outset.

- Are resellers or distributors already selling your products in Sweden and the Netherlands? Local resellers (either authorized or unauthorized third parties) create headaches for brands in new markets because sometimes there’s nothing stopping them from listing your items on Amazon. This creates potential brand control violations and/or channel conflicts. If you have distributors in Sweden and Netherlands, it would be wise to reach out asap and get clarity on who has ownership of the new Amazon channels.

- Who handles returns and customer service? Are you equipped to effectively manage the new Amazon marketplaces from an operational perspective? Failing to assign responsibility could result in poor brand optics and slow growth.

- What’s the right level of marketing investment for Sweden and the Netherlands? Even new Amazon marketplaces are pay-to-play. Failing to invest the right amount in marketing will stunt your brand’s growth. At the same time, overcommitting can seriously hurt profitability, especially in the early stages of the market’s lifecycle.

Need help assessing the Amazon Sweden and Netherlands opportunity?

Book a free consultation with a Bobsled expert below.

{{cta(‘0825dfed-dfd0-4c96-bfc0-9b14009fed23’)}}