Sally Kazin and Seth Hirsch are lead analytics at Acadia.

Being a mid-market brand in a market dominated by big players can feel defeating. How do you fight back against the big dogs when their budget dwarfs yours?

The answer is to use data and analytics to your advantage to spend less but smarter. As Acadia analytics leads we have laid out how challenger brands can rise to the occasion and stay competitive even without the deep pockets of their biggest competitors.

There’s a lot that holds clients back or gets in the way of how they see the potential of using data and analytics to improve their marketing strategies in a meaningful way. We hear the same myths. People assume they can’t afford it. Luckily, the data industry has evolved to account for budgets of all sizes, and more affordable tools are available – like the rise of cloud data platforms. Another myth is that people don’t have the right kind of data, or enough data. Any data set is bound to have holes – a missing email address, for instance. Third-party analytics firms can help to fill in the blanks. You can even start building a data roadmap from essentially no dataset at all. Finally, the third myth is that your customer is consistent, fits one mold and you already know everything there is to know about them. That’s never the case in reality – and you’ll be surprised.

We went deep in Acadia’s data practices, using the example of a mid-size regional electronics retailer that was dealing with a customer base that was difficult to define. Some were urban, others suburban. Awareness of the brand varied vastly by market. And ad impressions in their key market of New York City are incredibly costly. All of this meant that a peanut butter spread approach to their marketing wasn’t going to cut it. So the retailer worked with Acadia to put together a strategy that would be more reflective of who their customers actually are and where they are in the lifecycle to make the most of their marketing dollars and stay competitive – even against the category killers.

Build the foundation

Working with Acadia, this retailer already had the foundational work in place to get started on a new digital strategy backed by data.

This starts with gathering first party data – everything you already know about your customer based on the information they’ve shared with you. Step two is to break that first party data down into actionable subgroups of customers grouped by demographic characteristics. Who are the empty nesters? Who are the busy soccer parents with a family of four? What behaviors do they typically display? The way customers engage with your brand will vary depending on all of these factors, and you’ll need to market to them accordingly. Finally, the last piece is measurement – applying analytics to the data to understand what is and isn’t working.

Without understanding the data at hand, you’re likely to keep allocating budget in the same way, even if it means you’re not getting the best results.

Start segmenting

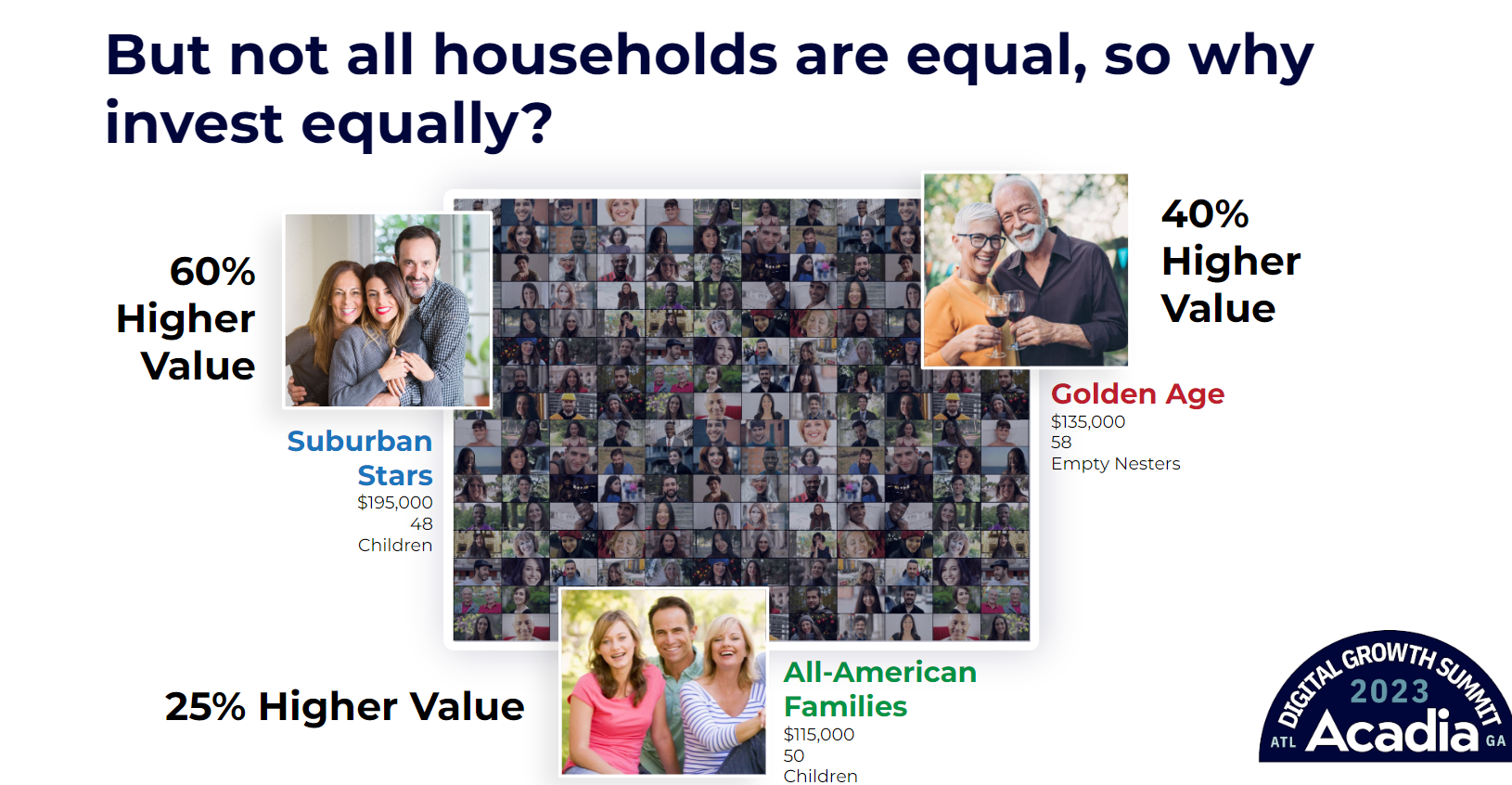

Once you have a dataset, you start drilling into it to learn as much as you can about your customers. The client in New York had a rich dataset, but was often thinking of all of their households as equal when that wasn’t the case. We wanted to solve that. After plumbing the data, we found that the retailer had three core groups of customers: the Suburban Stars, Golden Age and All American Families. Each group accounted for about 25% of sales, but each group held between 25 to 60% higher value than customers outside these groups. They’re high spending, high income, more likely to become customers and more likely to buy more than one product. These were the company’s most valuable customers.

The next step was to map the retailer’s store network to see how it compared to where these customers were most likely to live. If one store had coverage of about 60% high value customers, and another store had about 10%, that can guide marketing dollars and strategy down to a specific area that’s more likely to outperform. You don’t neglect the 10% store, but you make sure that your 60% store is set up to shine, counterbalancing weaker parts of the network.

When you combine all of this information – store locations, what percentage of the area around the store is made up of high value customers, and how many of those customers have already been acquired – you end up with a matrix that ranks stores by how they’re likely to perform. This can also tell you where you’re oversaturated, undersaturated, and where you can build brand awareness and incremental value.

This type of information is absolutely vital to a challenger brand. Without key insights in your back pocket that guide your next moves, you’ll be playing checkers while the big guns play chess.

Layering on your strategy

Now that you know where you need to be spending your time, energy and budget in order to lift sales and raise brand awareness, it’s time to layer on the digital strategy.

When you have highly segmented customer data, you can tailor your marketing spend and strategy down to the specific group. This might influence the creative you decide to show up in a certain area with, the messaging and the calls to action, down to the number of ads served and the cadence. It’s particularly important when you don’t have all the money to spend in all of the places. Using your budget more wisely by making investments backed by data lets you bet the most on the greatest opportunities.

This retailer invested in where they were already winning, in order to fortify their presence. They invested in the high value groups first, and then everyone else, so that they were prioritizing those most likely to become customers. And they listened: if anyone signaled they were searching for a new appliance, or made any other type of signal that they might be in the market, they’d get served ads for the company. It may just be retargeting, it might be storytelling with emotional ties, but it was all different levers working at once.

The results

After three to four months of implementing this strategy, the retailer is seeing comparable store growth of 3% at stores that had investment versus stores that didn’t. Moving forward, they’ll continue to test markets and types of creative, and the strategy will get smarter over time as the team continues to test and enhance the performance.

If you want to learn more about Acadia’s Analytics and Intelligence capabilities you can read more here.