Amazon Prime Big Deal Days 2024: The Results

With only three weeks of lead time, Prime Big Deal Days was an unexpected addition to Amazon brands’ calendars when it was announced on September 17. A new $50 Prime Exclusive Discount submission fee added another layer of annoyance and complication for brands.

But the scramble to get promotions, inventory and plans in place to make the most of the shopping event seems to have paid off, as it turned into a strong sale from October 7-8 – though on average still a bit shy of July’s Prime Day numbers.

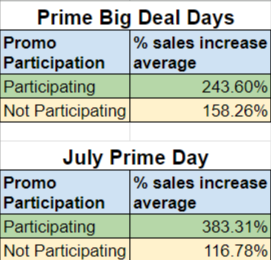

According to our data, Acadia clients who participated in Prime Big Deal Days saw a 243% increase in sales compared to two-day averages for the week prior. Prime Day in July 2024, meanwhile, lifted sales 383% for participating Acadia brands. But once again, Amazon proved that its deal events raise all ships: non-participating brands saw sales increases – and at a higher rate than the brands who didn’t participate in the July Event.

Prime Big Deal Days functioned a lot like Prime Day – meaning the brands that went into that shopping holiday confidently this July were prepared to repeat the same best practices this time around and make the most of the sales spree.

Overall, Acadia clients saw success, with sales up 41% over Prime Big Deal Days last year, showing the event itself still has untapped potential for year on year growth. Here’s how it all played out.

Short Lead Time, Big Buy-In

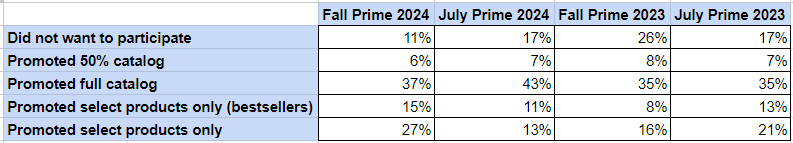

Despite the event being announced last minute, only 11% of Acadia clients didn’t participate, showing just how powerful Amazon’s built-in shopping holidays can provide a boost. In fact, participation was even higher than Prime Day 2024, with 17% of Acadia clients opting out (the same percentage of clients declined to participate in Prime Day 2023). Meanwhile, 89% of clients ran some kind of promotion.

Prime Big Deal Days – which first surfaced in 2022 under a different name – still has novelty for consumers, and it’s also closer to the holiday shopping period, making it a valuable opportunity for brands to drive sales.

For clients who did participate, the overall strategy remained the same as Prime Day, with a majority of clients applying discounts across their full catalogs in order to make the most of the traffic and shopping mindset.

About that Prime Exclusive Discount Fee

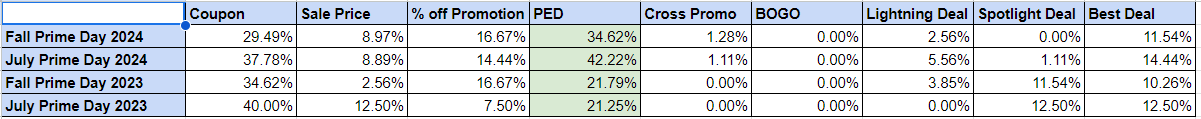

Amazon ruffled feathers when it announced, along with the event dates, that it would charge a fee of $50 for any Prime Exclusive Discounts (PED), which are an effective tool in incentivizing Prime members to purchase your product. Still, our data shows that the PED fee didn’t scare off Acadia clients at all – in fact, PEDs moved from the trend to staple during Prime Big Deal Days.

Last year, brands relied more heavily on coupons to drive sales. This time, PED participation increased by 61% over 2023. It’s a trend we’re seeing on Prime Day as well. In 2024, Acadia clients using PEDs for Prime Day increased 100% over Prime Day 2023.

This tells us that, even with a fee attached, Prime-exclusive discounts (which can either be a cash sum or percentage off the total) are big drivers for sales. It seems Amazon senses their value, too, as they’re now pay-to-play. All of this makes sense in the context of Big Deal Days acting as yet another point of value for capturing and retaining Prime members. We expect this trend to continue for future sales holidays as Amazon continues to prioritize merchandising (and potentially fees) for this promotion type specifically.

By Brand, Success Varied by Day

Overall, sales were up for Acadia clients for Prime Big Deal Days, but it was a mixed bag as to whether or not Day 1 or Day 2 reaped bigger rewards. When the two days’ numbers are combined, Prime Big Deal Days sales more than tripled average 2-day sales of the week prior.

Sales in aggregate on Day 2 fell 8% for Acadia clients compared to Day 1. But approximately one-third of clients actually saw an increase on Day 2, with those that experienced an increase notching on average a 36% increase compared to Day 1.

Advertising Highlights

While Prime Big Deal Days led to clear gains in PPC sales and orders, efficiency overall was down during the sales events. Overall, investment in advertising was up 183% for the period versus the same event last year.

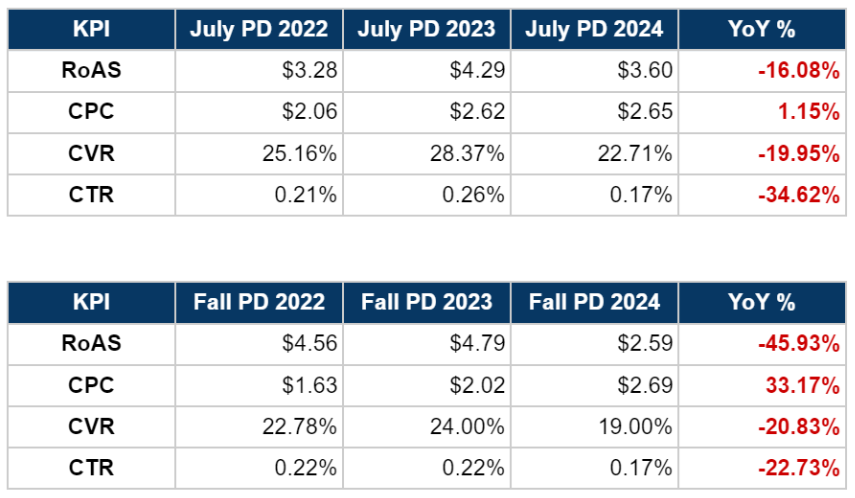

From our research, Acadia clients saw over the two-day period compared to the Fall Prime Big Deal Days of 2023:

- A 53% increase in PPC sales

- A 68% increase in PPC orders

- A 33% increase in CPCs

- A 21% decrease in CVR

- And a 46% decrease in ROAS.

This has been an ongoing trend from the past three years, across both Prime Day and the fall Prime Big Deal Days events: each time, more investment is required to see growth as efficiency declines.

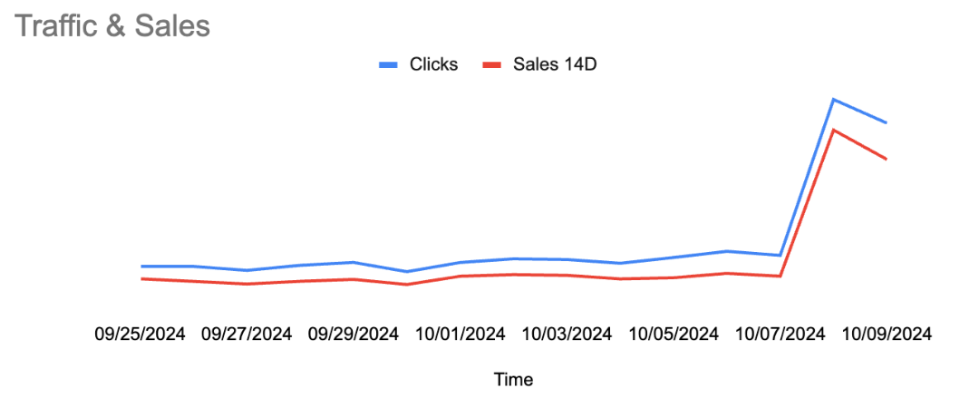

Traffic and sales data also showed that both remained flat for the two-week period in the lead-up to the event, before a two-day burst during the Big Deal Days.

Here’s what else to know about making the most of your ad spend during Prime Big Deal Days.

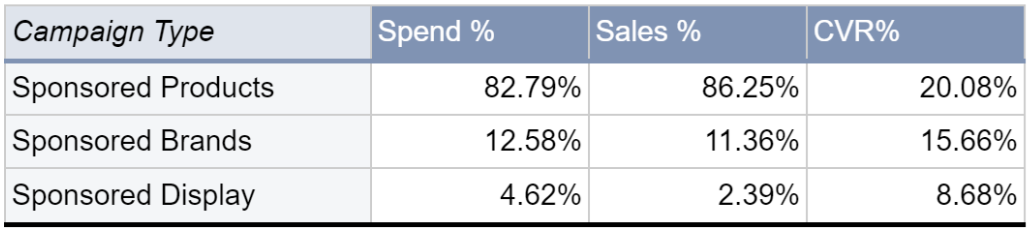

Sponsored Products on Top

Sponsored Products were Acadia clients’ ad type of choice, representing 83% of ad spend (that’s down slightly from last year’s 86%).

At the same time, Sponsored Products represented a higher portion of sales compared to last year, at 86% compared to 79%. That’s likely why Sponsored Products remain such a favorite among Acadia brands.

The Problem With Sponsored Brands During Prime Events

While still an important ad placement, Sponsored Brand ads continued their issues that have made them less of a reliable ad unit when compared to sponsored products.

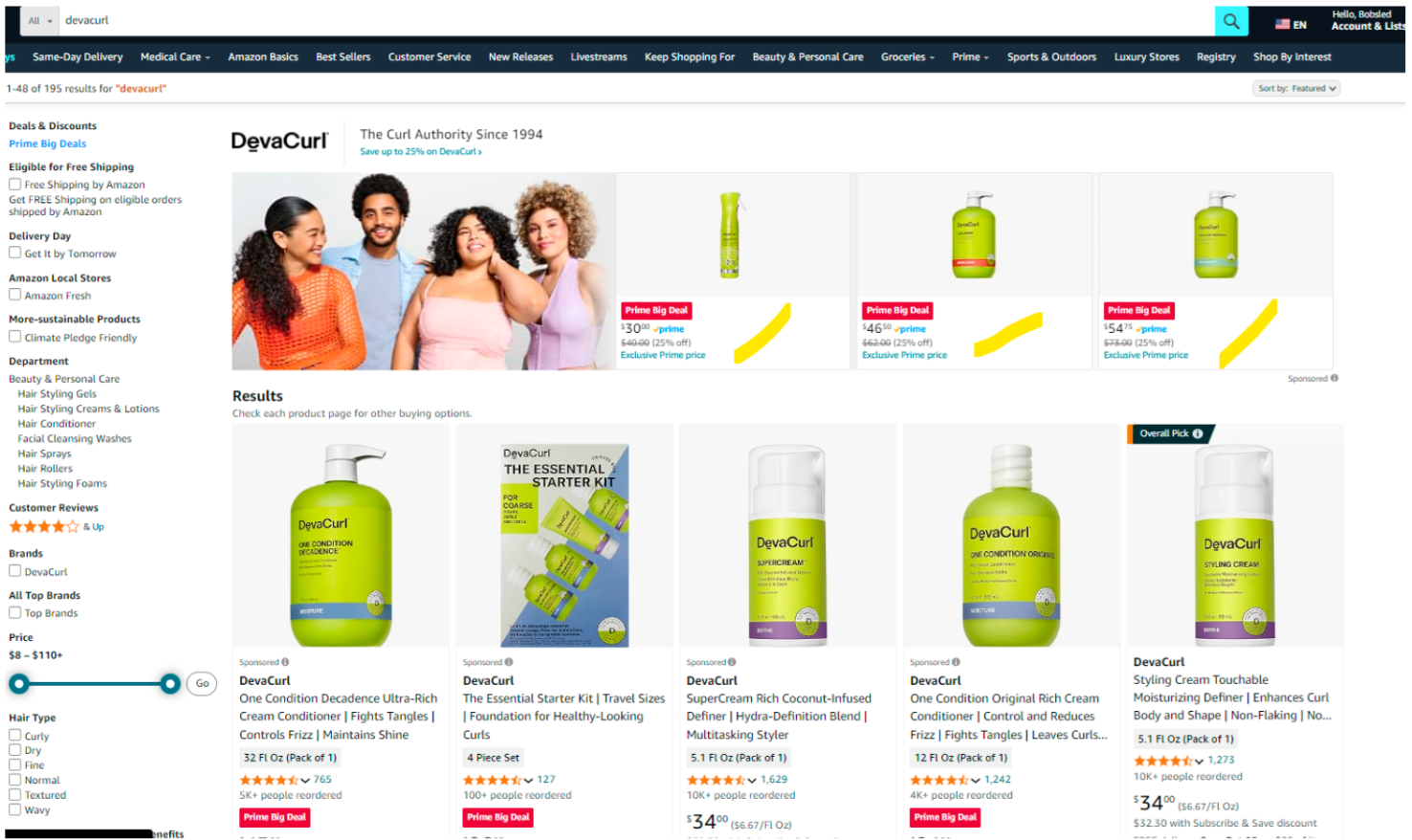

Amazon tags products that are part of its sales holidays with red deal badges – see the “Prime Big Deal” tag below – that forced out product titles from listings in Sponsored Brand banners. This is something we first noticed during Prime Day in July, and the same bug was back again for Prime Big Deal Days.

This is a big miss from Amazon, as customers are less likely to engage with the ad if they can’t tell what product they’re looking at. If they do engage, they might find it wasn’t the product they thought it was, leading to a poor customer experience. This will lead to either:

- Lower CTRs as customers choose not to engage with the ad

- Lower CVRs where customers engage with the ad, but don’t find what they’re looking to purchase.

And the proof is in the data. Comparing Prime Big Deal Days 2024 to the same event last year, CPCs were up 64%, while CTRs fell 9% and CVRs fell 27%.

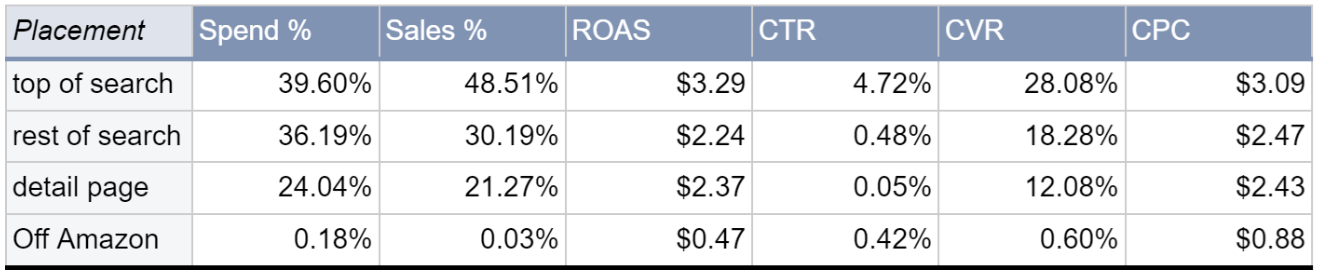

Secure the Top of Search

Appearing at the top of search queries with Sponsored Product ads is a consistently significant benefit for brands during Prime events. But how do you get there?

Acadia recommends increasing the number of search placement modifiers, especially during tentpole events, like Prime Day or Prime Big Deal Days, to secure that territory.

- CTRs are +880% higher than Rest of Search

- CVRs are 53% higher than Rest of Search

- ROAS provides +47% compared to Rest of Search

- CPCs are only +25% higher than Rest of Search

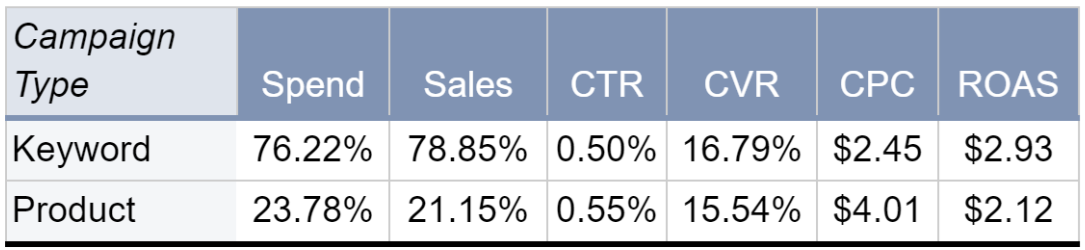

Keyword Wins

Keyword targeting or product targeting? During Prime Big Deal Days, it’s there’s a clear leader: keyword targeting is the better performer, according to Acadia’s research. Acadia’s client’s invested more heavily into keyword targeting, with 76% of the investment and 78% of sales.

The results?

- ROAS rose 38%

- CVR rose 8%

- CPC fell 39%

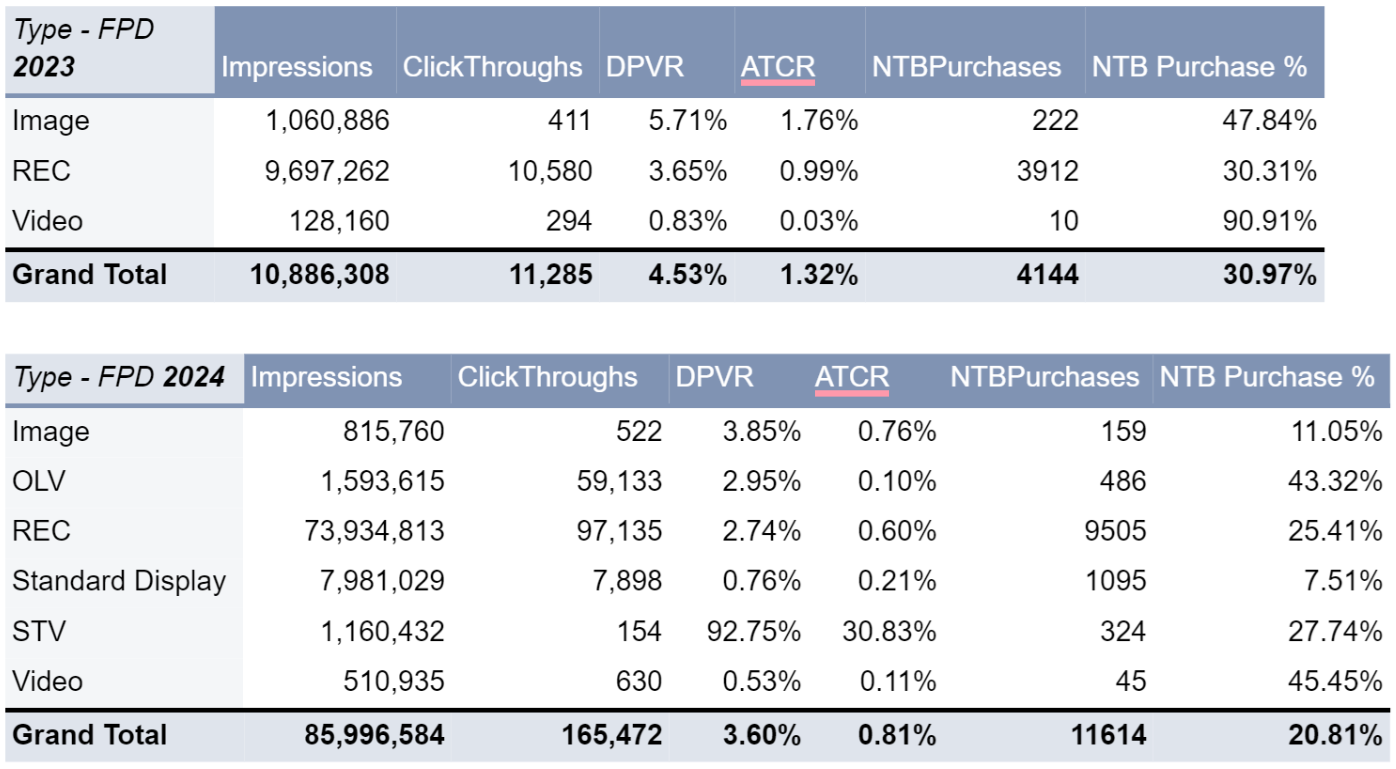

Don’t Forget the Top of the Funnel

In parallel with the developments of increased ad spend on top of funnel placements in Amazon’s ad ecosystem generally, we saw more brands that were willing to allocate meaningful percentages of their budget to DSP and OLV / STV placements specifically.

While mid- and bottom-funnel placements still take the vast majority of spend and conversion attribution, brands now understand that there’s opportunity to reach a wider set of buyers that are shopping on tentpole events.

In terms of the initial data, we can see the strong NTB Purchase Rate from OLV, and the high DPVR and ATCR from STV.

DSP YoY saw a 728% increase in click-throughs, which shows the effect OLV has had on this with a very high CTR of 3.71% – 2,753% higher than the 2nd highest CTR format, with 0.13% CTR.

Closing Thoughts

The bottom line? While sales growth wasn’t quite as high as what brands saw for Prime Day this July, the pay off in participating in Prime Big Deal Days is clear. Consider it an official part of the Amazon shopping event calendar and hopefully the start to a strong start to retail shopping in Q4.

If your brand’s performance was underwhelming, we can help! Now is the time to get things right for BFCM and Q4.

Request a consultation with our team.