The beauty industry is one of the fastest-growing - and fastest-changing - industries in the world. Brands that are looking to nurture major success with the sale of health products and cosmetics should consider the platform that is continuously favored by the world’s shoppers. Whether through Amazon, DTC, or retail stores, a brand needs a healthy blend of physical and digital channels to drive the biggest profits.

As one of Business Insider’s top-recognized Amazon firms, Bobsled commits hours of research to stay apprised of the latest beauty trends and data. Our commitment to employing the best marketing strategies for our clients has landed us on the Inc. 5000 list, and our omnichannel advice has even been mentioned by Amazon Advertising. Omnichannel expert Gary Hammerschlag leads brands through the major advantages and differences between Amazon, DTC, and retail selling.

Defining Beauty in the Marketplace

In today’s ever-growing competitive landscape, it is imperative that beauty brands continue shifting their focus to stay relevant across the globe. Trends come as quickly as they go, making it all the more important to stay up to date. No matter what the latest fad is, it always ends up falling into one or more of the six major categories that define a typical beauty brand. The industry’s revenue market share is segmented by the following:

- Hair Care - 24%

- Skin Care - 23.7%

- Cosmetics - 14.6%

- Perfumes and colognes - 9.5%

- Antiperspirant, personal care, feminine products - 8.5%

- Oral hygiene - 5.6%

Beauty Beyond Appearance

Regardless of market revenue statistics, today’s consumers have shown a trend towards health and wellness as a huge consideration factor in the beauty industry. For many, the concept of beauty is not only for one’s appearance. This should give brands an opportunity to focus on products that cater both to the consumers’ beauty-related values and their desire to make healthier choices.

How Big is the Beauty Industry?

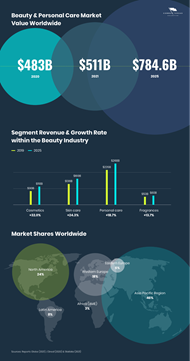

The above numbers reflect how each of the major beauty categories is divided within the market, but what numbers does the industry bring in as a whole?

Up from $483 billion in 2020 to $511 billion in 2021 - and with an annual compounded growth rate of 4.75% nationwide - it is predicted that the beauty industry will exceed $716 billion by 2025, and a whopping $784.6 billion by 2027.

Up from $483 billion in 2020 to $511 billion in 2021 - and with an annual compounded growth rate of 4.75% nationwide - it is predicted that the beauty industry will exceed $716 billion by 2025, and a whopping $784.6 billion by 2027.

But it’s not just the industry giants like Estee Lauder or L’oreal that make such a monetary impact across the globe; there is fierce competition between smaller brands as well. While different shopping and purchasing behaviors exist worldwide, brands of any size who are trying to make it big in the beauty industry should start thinking up a strategy that combines both digital and physical channels.

While the majority of beauty sales happen in retail stores, rapid changes are occurring that project online sales to make up 48% of total beauty revenue by 2023. An omnichannel approach is the best way to reach wider audiences and increase the beauty brand’s bottom line. A through-and-through comparison of Amazon, DTC, and retail stores can make it easier for you to determine the perfect channels that will help you make your mark in the beauty industry.

Amazon Beauty Brands

There are a significant number of brands who are skeptical about using the Amazon Marketplace when they first start out. Whether or not it is the space where you will earn the highest profits, it is a competitive territory that you must stake a claim in. If you don’t, you are giving that portion of the beauty industry’s market share to your competitors.

To stay competitive, beauty brands might consider investing in a strong strategy that prioritizes Amazon as their main marketing platform.

Why Amazon?

A recent Kantar custom survey of U.S. skincare product buyers showed that between 34% - 47% of consumers visit Amazon at some point in the purchasing process. This doesn’t always guarantee that a purchase will happen, but the platform is always a huge consideration for the average beauty consumer. Not to mention, eMarketer reports that 52.5% of Prime members bought beauty products in the past year alone.

Exponential Beauty Industry Growth

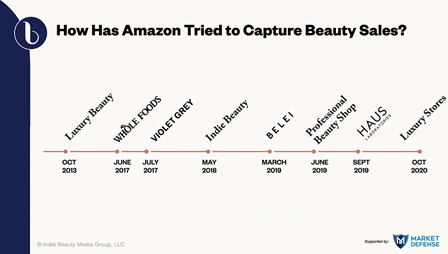

Amazon’s market capitalization in the beauty industry has soared to $1.7 trillion over the last few years. The biggest brands contributing to Amazon’s success include Amazon-owned Whole Foods, Lady Gaga’s HAUS brand, and BELEI.

Large Platform

It may come as no surprise to brands big and small, but Amazon is one of the largest retailers in the world. Where many other industries and organizations suffered a huge drop in revenue since 2020, Amazon managed to experience a 47% YoY increase. This means more traffic to your products on a daily basis.

Numerous Marketing Initiatives

To drive more awareness and conversions through Amazon, beauty brands can take advantage of marketing initiatives such as same-day delivery, low marketplace prices, and, of course, Amazon's Premium (Luxury) Beauty category. Premium Beauty offers “a curated collection of the world’s most sought-after luxury brands”, which is something that cannot be found on any other platform.

What to Consider When Selling on Amazon

1) Seller or Vendor?

One of the first tough decisions a beauty brand needs to make when selling on Amazon is whether to register as a Seller or a Vendor. Most luxury brands are on Seller Central, as Vendor Central typically doesn't allow for as much control over the display and branding of the products as well as customer service provided. Ultimately, brands worry if customers have a bad experience with their brand, this may damage a brand’s overall online image.

2) Luxury Brand “Gating”

In October of 2013, Amazon provided several luxury brands - such as Dior and La Mer - the opportunity to gate their products, essentially blocking third-party sales. This is why many larger brands choose to partner with Amazon; however, this system is not perfect and may still result in unlicensed sellers creating knock-offs on the grey market.

3) Content is Key

Content is always the key component for any beauty shelf on Amazon’s platform. With the ability to write elaborate product descriptions, plugin keywords, and upload an entire gallery of photos, there is no reason why your beauty products won’t get rewarded with higher search rankings. Beauty brands should start preparing to create specific copy - and visuals - to drive success on Amazon.

4) Extra Costs & Fees

Any brand that sells on Amazon will have to get used to a few different fees. For example, Amazon will charge a fee for fulfillment methods, referral codes, storage uses, and more. Fees are part of the general process of selling on Amazon, but with the added benefit of being a part of the world’s largest eCommerce platform.

5) Additional Logistics

It is not difficult for a beauty brand to get started on Amazon, but in order for a beauty brand to succeed on Amazon, they will need to focus specifically on this platform and create a long-term game plan that covers every aspect of the business, from accounting to logistics to inventory and more. Smaller or newer brands may struggle to take on all of this planning at once, which is why Bobsled experts work with hundreds of beauty brands to reduce the initial strain of an omnichannel marketing strategy.

DTC Beauty Brands

Brands that run their own eCommerce websites can sell DTC: direct-to-consumer. For most buyers around the world, the days of buying makeup from the counter at the mall are well over. In the face of the pandemic, many traditional stores expanded their digital storefronts just to stay afloat. Forbes reported that 75% of U.S. consumers have greatly changed their shopping habits over the last year.

DTC is still digital, but it’s the next best thing to a personalized beauty shopping experience. eCommerce retailers can still offer beauty expertise and one-on-one consultations to help customers get the same products they’ve always loved

Why DTC?

Whether a beauty brand has always focused most of its marketing efforts on DTC or they are considering a switch due to COVID-19, there has always been one major goal of shipping products directly to the consumer: growing a personal and individual relationship with customers.

Data-Driven Engagement

Today, nearly 70% of cosmetics retailers offer quizzes or personalized questionnaires to help customers find the best beauty products to suit their needs. Quizzes have some of the highest engagement rates of any type of online content, with users completing at least 81% of personalized quizzes for beauty products.

Profit-Sharing

When selling through Amazon or other retailers, brands lose a margin of their profits through the variety of fees we discussed above. Selling DTC limits the profit-sharing that exists when selling through other retailers while also allowing the brand to engage directly with their customers without the constraints of Amazon, or another retailer’s, policies.

Key Virtual Engagement

Some of the biggest trends in social media and viral video marketing are in the beauty industry, and brands can use this to their advantage while connecting with customers in brand-new ways. Beauty tutorial livestreaming, expert online courses, virtual video consultations, and augmented reality apps are just a few examples of virtual engagements possible through DTC marketing.

What to Consider When Selling DTC

1) Control the Entire Experience

Brands that mostly deal with DTC have the ability to control complete brand messaging without interference, but this leaves a lack of guidance and structure that some brands enjoy having through Amazon and similar sites. A brand might want to develop a well-rounded plan of engagement that includes blogs, social media, email marketing, interactive tools, influencer marketing and more.

Above: Sephora keeps customers in the loop with the Beauty Insider Community email campaign.

2) Increased Data Collection

Health and beauty brands that sell exclusively in retail stores largely miss out on customer data. That is where DTC brands can have a beneficial edge; it is easy to collect significant amounts of data when selling directly to the customer. Arguably, one of the biggest benefits of selling DTC is that brands essentially own the data of their customers. These brands can then leverage that data to serve those same customers through insightful initiatives.

3) Inclusivity

In recent years, beauty brands have become far more inclusive and aware than brands of the past. Small efforts to be more inclusive can help brands reach a wider audience and receive greater reviews. For example, Fenty features a face shade finder to help customers choose from over 40 different shades of foundation.

4) Upfront Investment

Brands should expect to invest a lot of capital on marketing initiatives to acquire a customer on their DTC website. This is especially apparent when compared with tried and true online marketplaces such as Amazon.

5) Google & Facebook Advertising

Beauty brands that want to emphasize DTC often rely on Google and Facebook advertising to drive traffic to their brand websites. Interestingly, brands now have the ability to use Amazon DSP customer data to their advantage, as it allows them to send qualified traffic.

Learn more about how to Use Amazon DSP to Direct Shoppers

to Your DTC Website.

Retail Store Beauty Brands

Interference from online channels - and the global COVID-19 pandemic - has brought huge obstacles to the retail beauty industry. However, beauty brands are continuing to invest their time and money in brick-and-mortar stores.

The Internet has been a huge help for the beauty industry, in particular, allowing brands to talk to their customers individually and on a larger scale. But despite these rapid changes, a lot of customers still want to visit physical stores and have retail experiences before buying their products.

Why Retail Stores?

According to an Opinium Retail Tracker survey, 50% of British consumers would rather buy their beauty products in the store, with only 16% of them saying they prefer to shop online. Both online and physical stores continue to grow in popularity, making retail selling a consistent possibility for beauty brands looking for success.

U.S. Shopping Trends

Surprisingly, the trending preference towards physical stores is prevalent in the United States as well. Gen Z, a group of consumers who are largely used to buying everything online, is starting to speak out in defense of brick and mortar shopping. A recent survey showed that 90% of Gen Z shoppers would rather get their beauty products from a store.

Personalization

More than one-third of customers who buy beauty products at the store believe that seeing, touching, and experiencing the product is the most important part of the buying process. People who shop online value product personalization over being able to view the tangible product; offering a combination of features is best for a brick-and-mortar store.

What to Consider When Selling in Retail Stores

1) Make-up Trials

Despite the convenience of online shopping, a vast majority of consumers still find the ability to try products in person to be an incredibly important value. Some DTC options allow customers to virtually try on products, but make-up trials in person are still considered to be more trustworthy. Customers can experience a product’s texture and scent, which is an irreplaceable experience.

2) Social Media

Social media is a big part of brick-and-mortar stores these days. 62% of American women follow more than one beauty influencer on social media. Total watch time for influencer videos on YouTube has increased by 7% year-over-year. Although social content often powers information and education for the masses, it cannot drive home a sales purchase online - that is what the in-person retail store is for.

3) Digital and Retail Harmony

Retail stores may be practicing traditional in-person selling, but that isn’t to say brands can’t embrace digital technology. In fact, it is a necessity to enhance their retail spaces and introduce new customer experiences. Sephora’s concept store in Shanghai has touchscreens where customers can buy items and try them on virtually before buying.

4) Aesthetic Messaging

Retail brands may want to focus their physical approach to appeal to today’s tech-savvy world. Consumers might still prefer an in-person experience, but they will still expect you to be apprised of the latest Internet trends and technological advances. In addition, brands that sell in department stores lack the aesthetic control to always deliver their brand messaging, depending on the nature of the retail space.

Build an Omnichannel Marketing Strategy Today!

In the ever-increasingly tough beauty industry, there are plenty of ways that small brands can make it big. As popular trends continue to shift in 2022 and beyond, there is one thing for certain: brands will want to combine both digital and physical selling channels in order to thrive in the beauty market. Build your omnichannel marketing strategy and schedule a free consultation with Bobsled to explore the best methods of success for your beauty brand!

On October 19th at 11 am EST, Bobsled Founder & CEO Kiri Masters will be hosting a very insightful webinar about 7 of the most important challenges ecommerce & digital leaders of omnichannel brands will face in the coming year.

REGISTER NOW TO SECURE A FREE SPOT