Walmart is becoming an enticing growth opportunity for many brands who sell on Amazon.

Walmart has been aggressively growing its marketplace capabilities including advertising improvements, rich product pages, and its own fulfillment program. While Walmart’s online GMV and monthly site visits are lower than Amazon, it is becoming a more attractive destination.

Source: Jungle Scout, Data from 2022

And we have seen this play out in the number of sellers flocking to the Walmart marketplace.

Walmart just reached only 100K active sellers on their marketplace.

(By comparison, it is estimated that there are currently over 9M sellers on Seller Central with close 2M actively selling on the platform as of early September 2023)

That means that the number of active sellers on the Walmart marketplace is only 5% of that on the Amazon marketplace.

Amazon, although there is still room to grow, is now a mature marketplace and platform and it is becoming more and more difficult (and expensive) to stand out on Amazon.

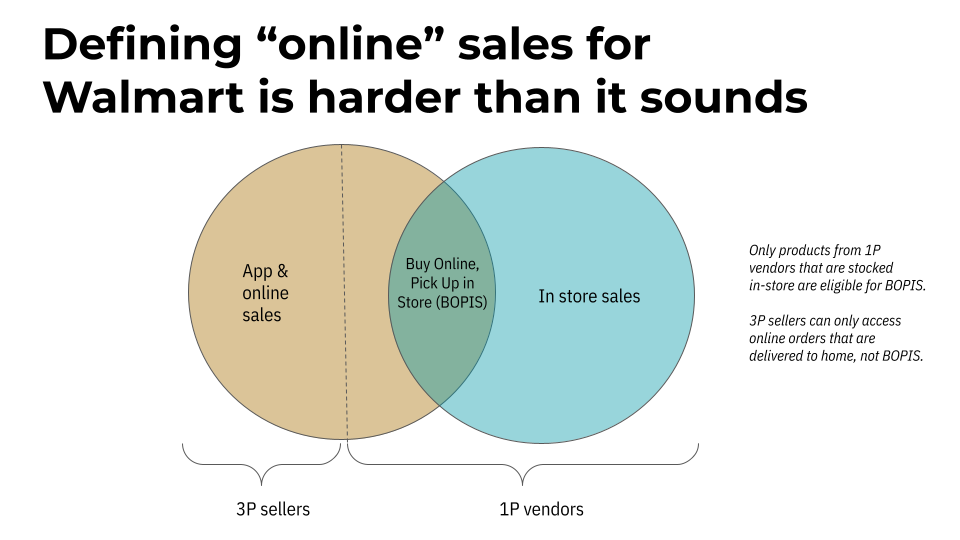

Walmart third-party (3P) sellers versus first-party (1P) vendors

Most brands who already sell to Walmart stores on a wholesale basis will be invited to sell on Walmart.com as a vendor. Although sometimes they are asked to be a marketplace seller first, before transitioning to a wholesale model.

But brands who don’t yet have this relationship are able to apply to sell as a Marketplace Seller, and the onboarding process is usually fairly painless (though it does help if someone with a relationship with Walmart Category Managers can vouch for your brand - reach out to us at Acadia if you want help here)

Most of the time, brands don’t have a choice about which selling model they use. But it does affect the overall sales potential for your brand.

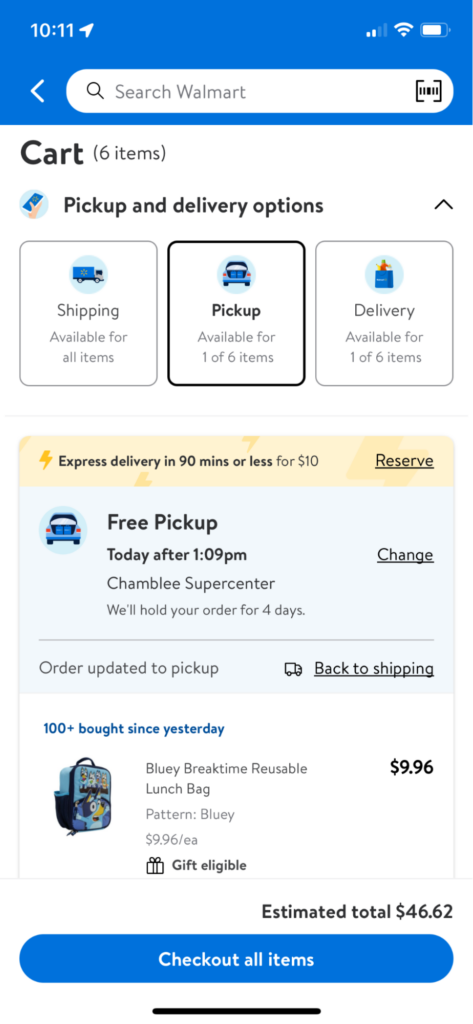

Let’s look at how a shopping cart looks with a combination of marketplace and 1P items.

I have 6 items in my cart. Only 1 item is 1P. But the marketplace items are only available through one of the 3 fulfillment options

- “Shipping” to home (1, 2, 3+ day delivery) can be 3P or 1P

- Pickup in store (BOPIS or Online Pickup) can only be 1P

- Delivery (same day) can only be 1P

Only products from 1P vendors that are stocked in-store are eligible for BOPIS. 3P sellers can only access online orders that are delivered to home, not BOPIS.

As such, selling as a 3P seller can limit your sales potential. And that’s why many brands have the ultimate goal of selling to Walmart on a wholesale basis, which leads to a big question that a lot of brands ask….

Can selling on Walmart.com help my brand get sold in Walmart stores?

In their educational content, Walmart often dangles an attractive carrot to potential marketplace sellers: if you do a great job as a marketplace seller, we may stock your brand in our stores.

Well, that opportunity is like catnip to many brands. But how frequently does that actually happen? Personally, I have only heard of one brand who has ‘crossed the chasm’ from 3P to 1P. If you know of other examples, I would love to hear from you!

Still, the concept checks out. Unlike Amazon where the 1P and 3P side of the business often seem at odds with each other (e.g. prohibiting 1Ps from becoming 3Ps, even if that model suits them better), Walmart has a more hands-on, personalized approach to category management. Category managers are deeply involved in curating storefronts, creating category pages, and selecting specific campaigns like the Clean beauty store or seasonal initiatives like back-to-school promotions. The process of selection involves significant consideration, necessitating that brands maintain a high content quality score to be prioritized for these marketing programs.

Walmart Category Managers usually manage the category across both in-store (1P) and online platforms. So being the top-of-the-pile on the marketplace should catch the eye of the category manager.

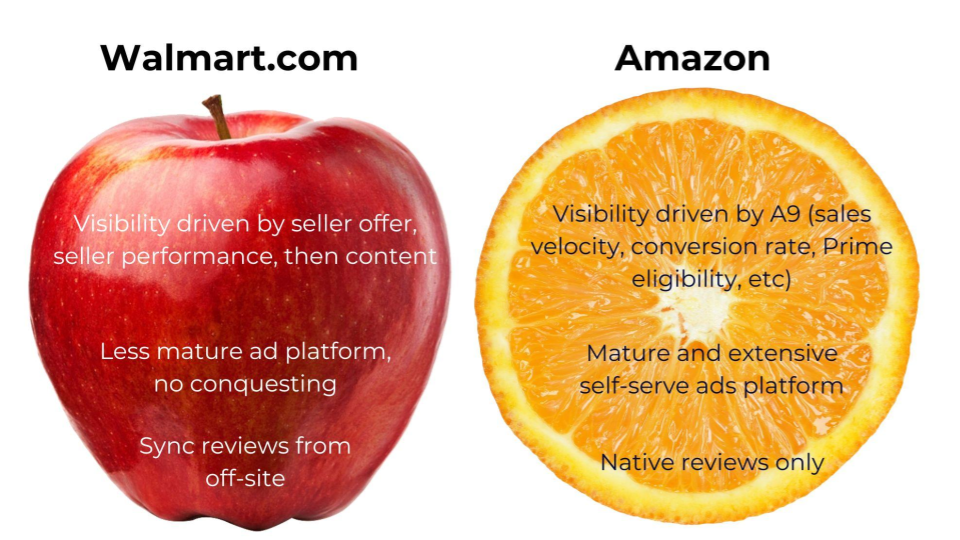

Walmart and Amazon require different approaches to be successful

Walmart and Amazon are like ‘apples and oranges’ in many ways.

- Organic visibility. As mentioned earlier, organic visibility on Walmart is largely driven by the listing quality score. Read more about this in our detailed blog post.

- Ad platform. There are many nuances to Walmart’s ad platform, and it is certainly less mature than Amazon’s, but it can be wildly successful for brands, such as in our work with the maker of Takis, Barcel.

- Walmart actually has a more robust product review capability, which for brands who have hit their heads against a wall trying to get compliant Amazon reviews, is a godsend. More on that below.

And finally, the Walmart shopper is simply different to an Amazon shopper!

Both retailers have membership programs, and while there’s undoubtedly a cohort of consumers who maintain both memberships, there is also a group of people who are Walmart loyalists and don’t have a Prime membership.

This data from Profitero shows that search activity on Walmart is even different to Amazon. So brands must take a unique approach to their keyword research and product optimization on Walmart.

Walmart product review generation

We wrote a detailed blog post covering all the different product review syndication options on Walmart. Here’s the short version: Walmart, through various programs and partnerships, allows brands to syndicate product reviews from their DTC site to Walmart. What a win! This gives a huge leg-up to brands who are new to Walmart. They can build consumer trust much faster, without having to start from scratch.

In an interview with the eCommerce Director at nutrition company Algaecal, I learned that their “Product listing quality & rewards” score rose from 70% to 97% and their product conversion rate improved dramatically after they used Yotpo to synch product reviews from the brand’s DTC site.

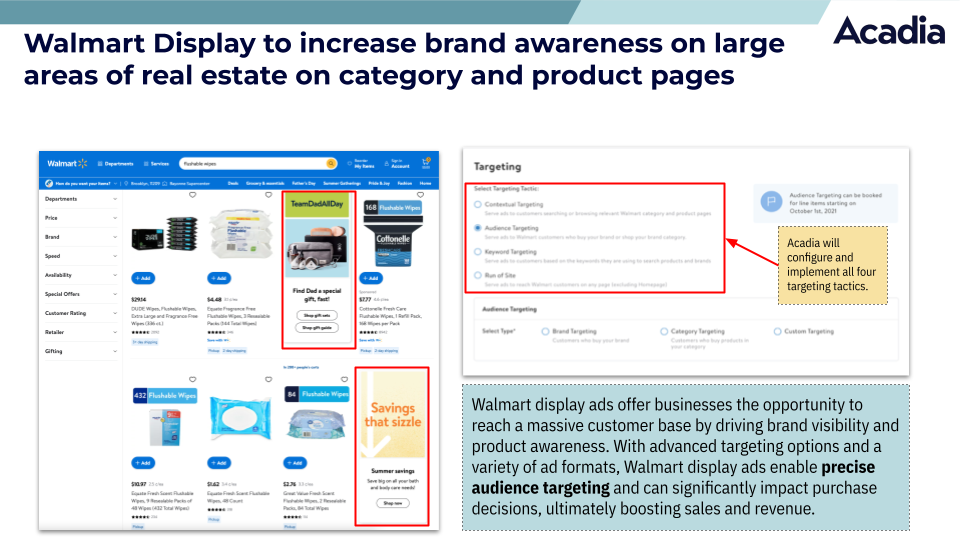

Walmart advertising capabilities

Walmart Connect is Walmart’s advertising platform. And it operates quite differently to it’s competitor, Amazon. Here are a few key differences:

- No competitor conquesting (Or, not yet “officially”!)

- Search terms must relate to attributes

- Some ad types, targeting options do not exist yet (e.g. Sponsored Display)

- No negative keyword capability on some match types

So a different approach is required on Walmart. However, Walmart Connect is growing quickly in terms of capabilities, and we can still use this advertising platform to drive full-funnel results on Walmart. Walmart’s display ads capabilities means we can target customers who are ‘in-market’ for a certain product (e.g. coffee makers) and also customers who are in-market for related products like coffee beans.

As we go deeper - we can laser in our ideal persona and lifestyle customer: foodies, fashionistas, etc.

With display we can even utilize more custom images and headlines to capture attention.

Get help from a certified Walmart agency

At Acadia, we have been helping brands master the Walmart sales channel since 2018. We are a Walmart Partner (listed under our old name, Bobsled Marketing). We can help with Walmart.com advertising, as well as full channel management (supporting new item setup, PDP optimization, inventory planning, etc). Read more about our Walmart agency services here.

In conclusion

Walmart.com's emergence as a major player in the ecommerce landscape has opened up exciting opportunities for brands seeking exponential growth. By understanding the key differences between Walmart and Amazon, brands can position themselves strategically to leverage the unique advantages that Walmart.com offers. However, it is essential to prioritize content optimization, align with Walmart's listed quality score metrics, and establish a solid foundation on Amazon before venturing into other ecommerce channels. Unleash your ecommerce potential with these insights and embark on a successful journey with Walmart.com.

Kiri Masters, Head of Retail Marketplace Strategy at Acadia