It makes me feel old to say that Amazon’s DSP (demand side platform) has been around for over 10 years now. As the platform matures over the years, Amazon has added many new features to help brands understand the impact that this impression-based advertising format has on overall sales.

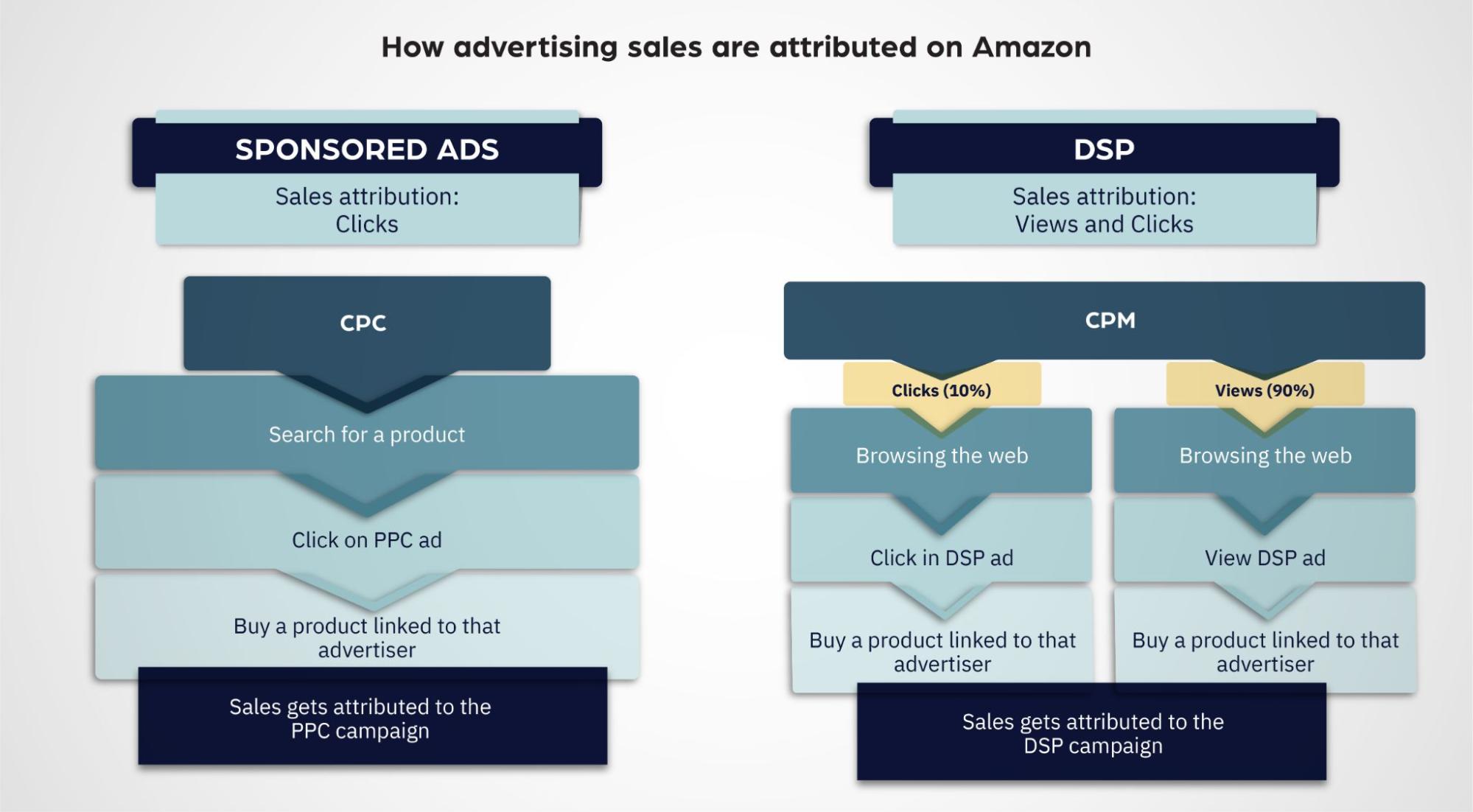

But the reality is, tying actual sales performance back to Amazon DSP campaigns is still challenging. That’s because the majority of DSP sales attributed through views and we cannot be 100% sure that my ad was seen and influenced a sales.

To be fair, measuring advertising effectiveness is not a challenge that’s unique to Amazon DSP. While media mix modeling and other media measurement capabilities get us close, it’s not possible to know exactly how many ads on different channels a customer saw before purchasing a product. I might first see a product advertised on a billboard, then on TV, and then walk past an in-store display at my local grocery store. But if I click on an Amazon ad for the product a few weeks later, its the Amazon ad that gets all the “credit” for the sale.

Still - from tens of thousands of hours spent managing Amazon ad campaigns for clients in various categories, the Acadia retail media team has seen such strong results from Amazon DSP campaigns that we believe that Amazon DSP advertising can drive ‘incremental’ sales - that is - sales that would not have been registered without those ad campaigns.

We were recently able to test our conviction when a client - a multinational house of brands - decided to take 2 different approaches to Amazon DSP among 4 of their brands in the personal care category.

The outcome?

2 brands took a “dip a toe in” approach and saw minimal outcome.

Brand A had between a $2.5k and $16k/week budget. It didn't move the total sales needle very much but we added about 7-9k glance views per week. Average total sales went from $93k to $103k/week.

The approach: Because they had a lower budget we opted for lower and mid funnel goals of purchase and consideration. Our KPIs were total ROAS, detail page views and new to brand sales. When budgets are smaller, we recommend focusing on a smaller number of goals over a full funnel approach. This helps brands get the most out of their investment and not spread themselves too thin.

Brand B had $3k-$5k/week in DSP budget. Their weekly total sales went from $344k to $375k/week over the course of about 4 months. Average weekly glance views went from 67k to 84k.

The approach: We used the same strategic approach as above to limit the number of goals we utilized to aligned with this budget. Another pillar of our strategy is to limit our product focus so that we can measure the incremental impact to a smaller subset of products from our ads and scale that up when we show success.

2 brands took a “dive head-first” approach and saw a big swing in sales that couldn’t be attributed to other efforts.

Brand C had about $19k/week in DSP budget. Their weekly total sales went from $262k to $330k. Glance views went from 57k to 86k per week. Our full funnel approach was leveraged here for the brands top 20 products. Loyalty, purchase, consideration and awareness with a mix of REC and custom image ads.

Brand D spends about $19k/week in DSP. Their total sales went from $580k/week to $770k/week. glance views increased from 121k to 169k. The approach here again was a ‘full funnel’ targeting strategy across the brand’s top 20 products.

Worth noting: Each brand has a slightly different value proposition, but sell more or less the same type of products.

The takeaway? Driving incremental growth with Amazon DSP is more than possible, but results are going to be underwhelming (or impossible to reliably discern) if only a minimal budget is applied to test. In cases where a brand is unable to invest more than $5K per week, I would candidly recommend just spending this budget in Amazon PPC advertising where it will likely make a good impact.

Using the right metrics to measure success is also key. DSP metrics should be based on your brand’s overall goals, maturity, repurchase frequency. My colleagues produced an amazing resource on this topic, named Fit For Purpose: Next-generation metrics for Amazon DSP.

And if you’re looking for help maximizing your Amazon advertising investment, Acadia is an award-winning agency with Amazon Advertising ‘advanced partner’ status, that has been working with medium and large consumer brands on Amazon since 2015. Reach out to us for a consultation today.

Ross Walker, Senior Paid Media Manager at Acadia