Why Amazon-Fluent Companies Outperform Peers by 16%

Kiri Masters is Head of Retail Marketplace Strategy at Bobsled, an Acadia company, and the Founder of Bobsled Marketing.

Amazon is different to other retail channels. That is the under-statement of the decade for those familiar with the channel. But if you’re one of those people - you’d be surprised how many conversations we have with brands today where this is the underlying message, and reason for their dissatisfaction with their performance.

The many ways that Amazon is different - operationally, rules, best practices, marketing opportunities - means that it can be poorly understood, and sometimes underestimated.

I founded Bobsled in 2015, and over the years I have noted changing attitudes toward Amazon. As attitudes change, the organization’s buy-in and resourcing changes too. I’ve seen those companies who change and evolve become more successful. And some companies who resist or underestimate Amazon get left behind.

This observation led to some new research that we are launching on August 16, in collaboration with the retail intelligence firm Stratably. You can sign up for the webinar here or to receive the research report here.

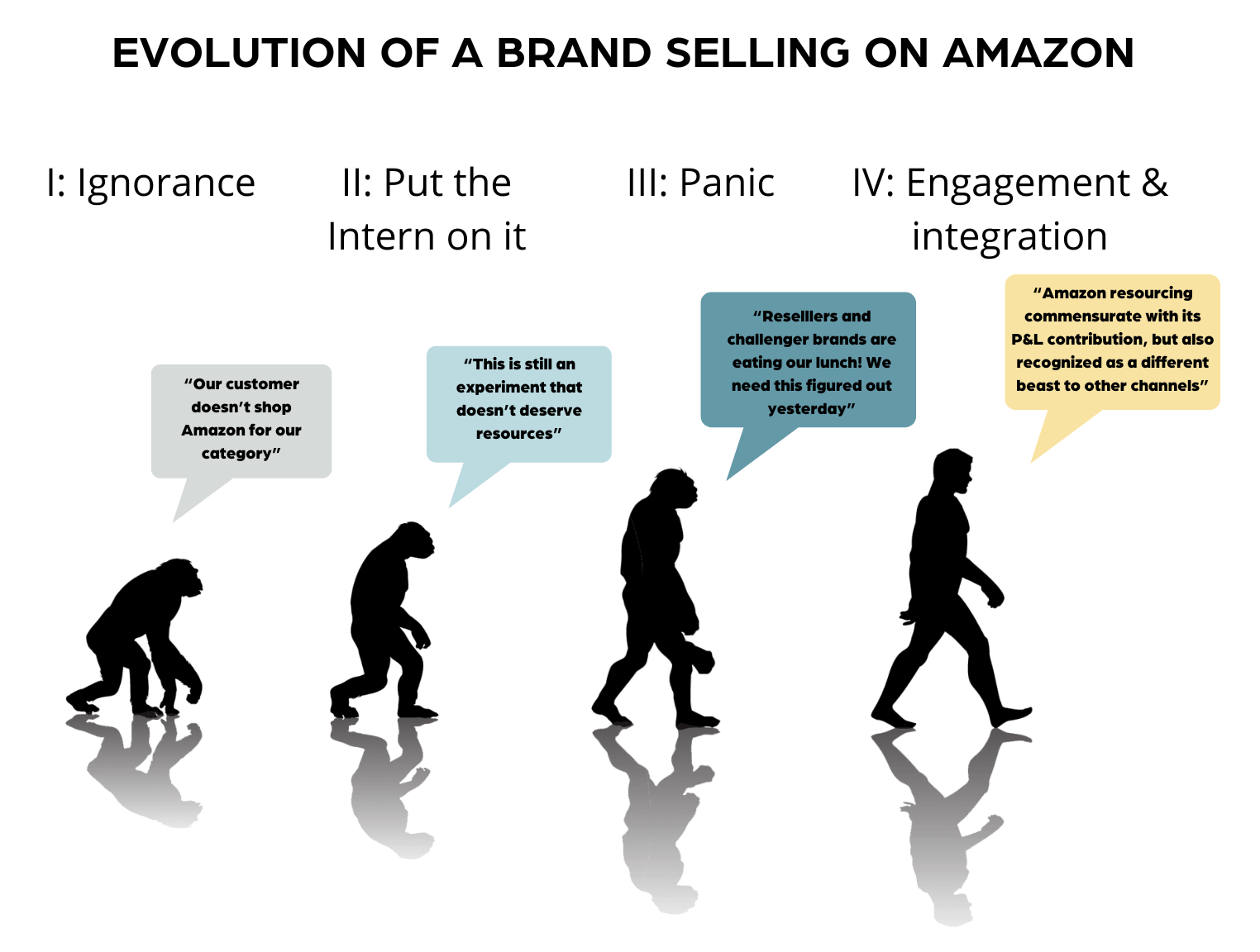

In the meantime, here is what I have noticed about the evolutionary journey that established brands typically follow as they eventually level-up to Amazon maturity. How evolved is your company?

Stage 1: Ignorance

This internal resistance is actually the most nefarious deterrent to Amazon success. When I first started Bobsled in 2015, I would often need to make the business case for an established brand to actually start selling on Amazon. There was significant resistance to actually selling on the marketplace. At a minimum, there was a perception challenge: “Isn’t Amazon a place to buy books?” And sometimes outright dismissal: “We don’t want our premium brand to be in the same cart as toilet paper.”

Amazon flew under the radar as a channel for many national brands, while resellers are much faster to recognize the opportunity and start filing the gap. Amazon-first brands like Anker start to spring up.

Stage 2: Put the Intern on it

Eventually, enough people started shopping regularly on Amazon themselves to figure that their own brand might benefit from being sold there.

But there was still an executive engagement challenge. Amazon only courted and coddled the largest brands, while the mid-market and smaller companies were left to figure it out by themselves.

So began a phase where being on Amazon was deemed to be experimental. A low-stakes project. “Let’s just put the intern on it and see what happens.”

Stage 3: Panic

A steady stream of data points become impossible to ignore:

Amazon is on track to become the world’s largest retailer. Half of US households are Prime members. Amazon accounts for half of every ecommerce dollar spent.

Amazon is officially on the map as a buying channel, and brands realize there is some catching-up to do. This is where the hard knocks start coming. Turns out that Amazon is not at all like selling to national retailers. The channel is incredibly complex, featuring a unique flywheel, language, and critical procedures compared to other retail accounts. There are rules, but they are arbitrarily enforced. There are best practices, but not all of them produce a meaningful effect.

Around this time, many brands realize that resellers and distributors have been selling their products on Amazon for some time. This is a missed opportunity for more revenue and data. There may also be branding issues brewing as a result. Anyone who shops regularly on Amazon has likely experienced at least one counterfeit, expired product, or obviously used item. Or at the very least, confusing and contradictory product content that causes shoppers to move on.

There is some serious catching up to do.

Stage 4: Engagement and integration

Brands that evolve past the panic stage are able to integrate Amazon into their lineup of retailers. The channel is given appropriate resourcing, and it becomes a meaningful line item on their P&L - both as a cost, and revenue opportunity.

A higher level of consciousness…. And performance

Today, most brands I spoke with are beyond the “intern” stage, and hover between “panic” and proper engagement.

Meaningful outperformance can come when a brand commits to several key factors on the channel. In our experience working with brands over the years, we’ve known this intuitively. The brands who adapt their business processes and cultures to work better on Amazon nearly always outperform their peers.

To see how robust this intuition was, and whether there is actually a clear link between commitment and outperformance, we surveyed 108 consumer brands on a handful of factors like executive buy-in, KPIs measured, supply chain prioritization, and the willingness to test and learn.

The results demonstrate, to varying degrees, just how important each of these four elements are in determining the likelihood of success on Amazon. When combined, these factors create a consumer brand “Black Belt” that outperforms peers lacking one or more of these elements by 16%.

The goal of this study is to provide Amazon account managers and their colleagues with quantitative results that will support robust internal discussions on the key areas that can be improved to maximize the odds of success on Amazon. These can be taken back to your company for some provocative conversations, and hopefully spur some progress to the next stage of your brand’s evolution.

Article originally posted on the Bobsled Marketing website, here.