If you use Amazon DSP for advertising, then Amazon Marketing Cloud (AMC) is one of the most important tools you might be overlooking. AMC can help you answer key questions about what your advertising funnel really looks like, the typical path to purchase your customers take, and more.

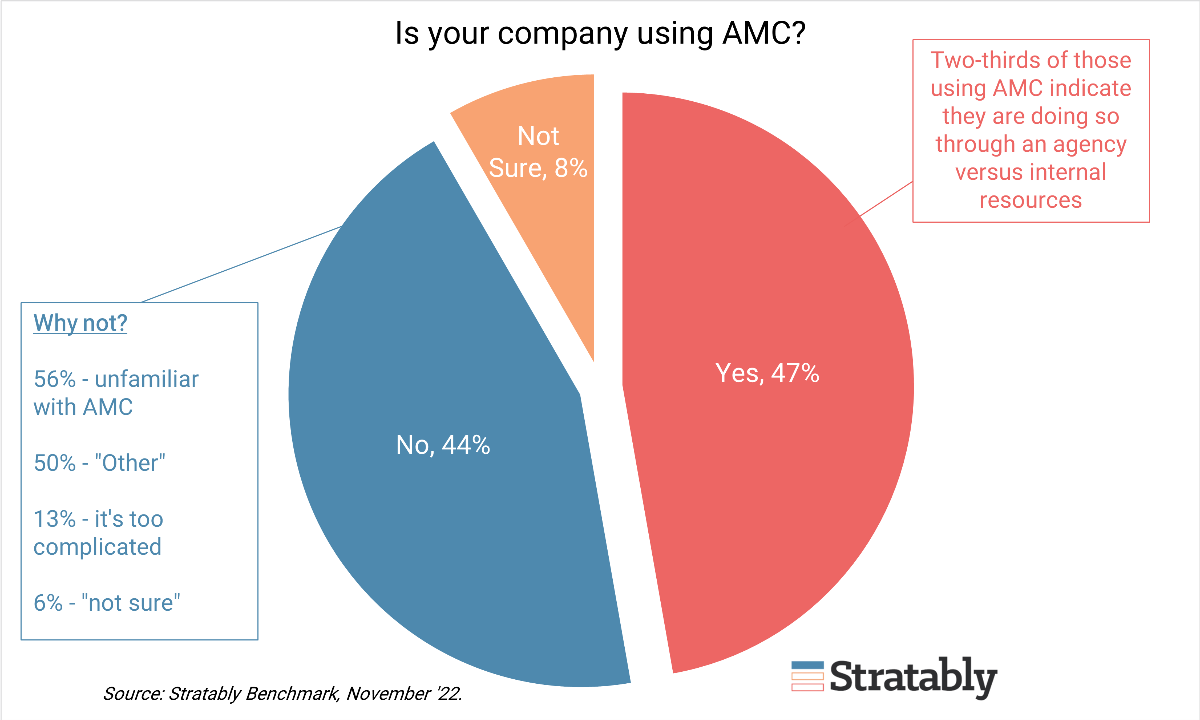

According to Stratably, 44% of brands are not yet using AMC. Mostly, brands seem to be avoiding AMC because they don’t understand how it works.

That reaction is more than understandable. AMC is complicated: it requires knowledge of SQL, and it often generates reports so complicated that you need business intelligence software to analyze them. But for brands that regularly DSP advertising, AMC is almost certainly worth their time.

Below, I’ll break down some of the most frequent questions I am asked about how AMC works, and in the process show the upsides of AMC.

How do I load first-party data into Amazon Marketing Cloud (AMC), and what can I do with it?

One key benefit of AMC is that it doesn’t exclusively rely on Amazon’s customer data. You can also upload your own, first-party data from your DTC site, and then map your data onto Amazon’s. This 1st party data is anonymized and compared in a clean room.

To do this, you simply upload your data sheet directly into the AMC platform. There, your first-party data is anonymized and compared in a clean room, so it will be secure. AMC lets you analyze two kinds of data:

- Identifier data: These are the data points that tell you who a customer is. Think of a customer’s email, location, or phone number. (When you upload your 1P identifier data into AMC, Amazon encrypts it.)

- Action events: These are logs of what your customers did. Did they visit your website? Subscribe to your newsletter? Add an item into their shopping cart? Convert in some other way?

One of the most important benefits of uploading your own first-party data to AMC is that you can start to match Amazon’s data with your own. When you upload a batch of identifier and action data to Amazon, you can fill in more detail about who your customers are.

If, say, the email addresses you upload match email addresses in Amazon’s system, you can track customer journeys on both your site and on Amazon. How many of your customers are finding you on Amazon first and then buying from your DTC website? What about the reverse: How many are finding you through your DTC site and then ultimately going to Amazon to make a purchase? When you upload your 1P data to AMC, you can answer these critical questions.

AMC can also match your first-party customer data to third-party databases that give greater insight into customer purchase histories. For instance, even though Amazon itself doesn’t sell cars, AMC taps into a third-party database of car buyers. AMC can therefore track what those car buyers are doing online. Have they been shopping on Amazon for car parts? Oil? Are there signals that they might be looking to make another car purchase soon?

What does a report look like on AMC?

The ultimate goal of AMC is to generate reports in response to your queries. How those reports look depends a lot on your question. I have had some queries produce 50,000 rows of data, and I have had others generate very little.

For instance, say you want to know the new-to-brand sales percentage for each of your products. This is a relatively simple question, and it will generate a simple report. If you have 100 ASINs, a query about your new-to-brand rate will only return 100 rows of data.

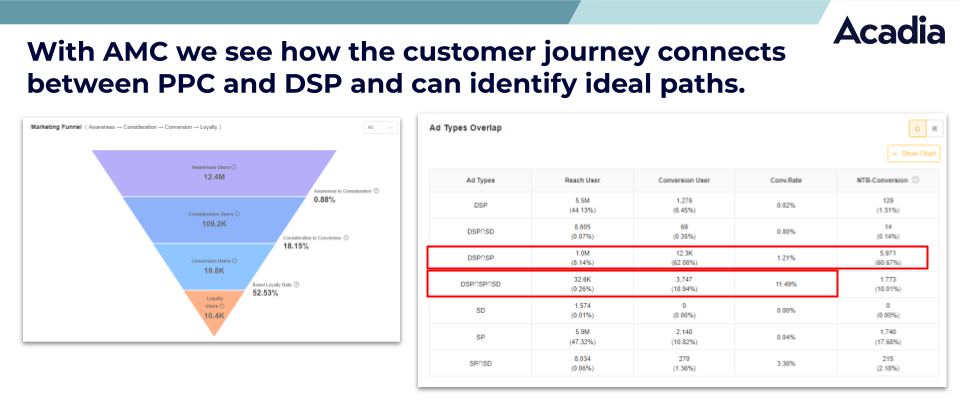

Other questions are far more complex. Many brands want to use AMC to create a path-to-purchase report. That way, they can see every permutation of how customers bought from them. They want to know, which ads did a customer interact with before making a purchase? Given how many paths to purchase there are, the number of rows quickly becomes exponential.

When AMC reports generate a lot of data, you’re going to want help breaking them down. You can’t analyze these reports in Excel, and they will crash most computers. At Acadia, we rely on sophisticated computers and business intelligence software to perform analyses of, for instance, path-to-purchase reports.

Is there a minimum spend I need for AMC data to be useful?

AMC is an incredibly sophisticated tool, but I’ve found that it is most useful for brands that spend consistently on Amazon DSP.

Keep in mind that your AMC queries will only run once you cross a minimum threshold of user data. If you’re only one month into using DSP, chances are you haven’t generated enough user data to make running AMC queries worth it yet. Similarly, if you’ve run DSP for several months but your monthly ad spend is low, it’s possible that there isn’t enough data for AMC.

Generally, at Acadia, we’re finding that AMC analysis makes the most sense for brands that spend at least $100k a month on Amazon DSP. There are exceptions to this, however, and we can always work with you to determine whether AMC is a good fit given your level of DSP spending.

Can I upload existing, historic data to AMC and use it for the strategy?

An important fact to keep in mind with AMC is that it has a limited look-back period. You can only run queries on data that is 90 days old or less.

Once you run a query, however, the report is saved in the AMC indefinitely. That means, if you want to perform year-over-year comparisons in AMC, you can theoretically run reports every 90 days and then match them up later. You just can’t run reports retroactively—so make sure to generate a report at least every quarter, before your data disappears.

How frequently should I run AMC’s data analysis?

As we discussed, the AMC look-back window is just 90 days, so you most likely will want to run reports at least quarterly to capture all of the data. But should you run reports more frequently than every 90 days?

The answer is probably yes, but figuring out how often to run AMC reports depends a lot on the amount of data you have and the specificity of your questions. For most brands, running AMC reports daily or even weekly probably doesn’t make sense, because they won’t have enough new data for their queries to return much information. Instead, for most brands, there’s probably a happy medium somewhere in the range of monthly analyses.

How can running an analysis in AMC impact how I allocate my ad budget?

The beauty of AMC is that it can tell you where—and how much—you should be spending on ads. I recently had a premium hair care brand come to me with a simple question: what was the new-to-brand rate for all of their ad campaigns, and which of their ASINs had the best new-to-brand rate?

In other words, they wanted to figure out which product was converting the highest share of new customers.

After running an analysis in AMC, we found that one of the brand’s less successful products—meaning, not one of their sales leaders—had the highest percentage of new-to-brand customers. We decided to allocate more budget to promote this product, seeing as it was attracting so many new shoppers.

The ad allocation was an immediate success: the product shot up in sales, and it became one of the brand’s top 5 products over a recent holiday period.

We may not have been able to identify a diamond in the rough like this without the analysis tools in AMC.

Other clients have come to me with questions about ad formats. Shoppers usually interact with multiple ads before they convert, but often brands want to know which ad formats are most critical toward driving a conversion. Among DSP, sponsored product ads, sponsored display ads, and others, which is influencing customers the most? Questions like this are easy to answer in AMC.

Want to know if AMC is right for you? At Acadia, we can walk you through how to use AMC—and once you get started, we can help you analyze the most complicated AMC data sets, such as path-to-purchase reports. Get in touch with us for more.