Kiri Masters, head of retail strategy at Acadia, is quoted in Ad Age on August 15, 2023, where Acadia’s original analysis of retail media network launches is also cited.

In the U.S., retail media ad spend is expected to reach $45.15 billion this year, a 20% rise over 2022, according to Insider Intelligence

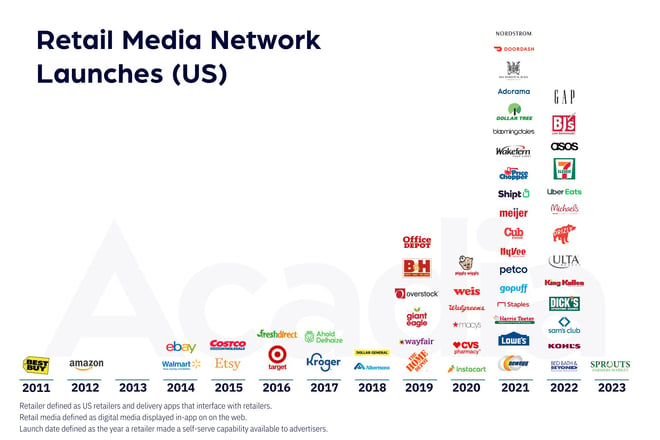

But that pace may be slowing, experts say. For example, of the 56 retail media launches since 2011, 31, or 55%, took place in 2021 and 2022, a recent analysis by digital agency Acadia found. So far this year, Acadia found that just one retail media network has debuted—from grocery chain Sprouts. At least one, from Gap, has shuttered after just a year of existence. “The vibe has shifted since this time last year,” said Kiri Masters, head of retail marketplace strategy at Acadia.

Despite a large number of recent entrants to the category, the top-performing retail media networks have remained the same in the last few years. Retail giants such as Amazon and Walmart have been offering advertising as a service to brands for years. Particularly now, amid tough economic conditions, brands are choosing to go with the tried and true over retailers that are just now starting to grow their media offerings.

“At a time of economic belt-tightening, brands want to go with the sure winner who is going to deliver a viable return,” said Masters, noting that those at the top of the list like Amazon offer reliable returns and advanced advertising capabilities. “Amazon is a sure bet.”

Read the full article, Retail Media Networks—everything Ad Buyers And Sellers Need To Know About The $125 Billion Trend, published August 15, 2023 in Ad Age.