2023 was the 2nd Prime event that Amazon has hosted in the fall, in addition to a summertime Prime Day event - Prime Big Deal Days.

This week - like the other ‘tentpole’ sales events throughout the year - is a long one. Late nights, early mornings, and a whole lot of camaraderie among the team to get the best outcome possible! As we draw “PBDD” to a close, we can start to draw some insights about the event from our client base of +100 vendors and sellers. It’s especially important to take these learnings now because Black Friday/ Cyber Monday is right around the corner.

Below are some of our initial findings from the Prime Big Deal Days event. Note that we are not yet able to calculate accurate sales numbers because sales data has not been loaded in Vendor Central for the 2nd day of the event.

Key findings:

- Amazon’s own investment in this event as a crucial factor

- Brands participated slightly less in deals and discounts vs Summer Prime Day

- Coupons and Prime Exclusive Deals were the most popular type of discount

- Being first in the line-up is key to winning on the day

- CPCs for Sponsored Brand Ads went through the roof (the importance of being responsive)

- The first day was much bigger than the 2nd

- Amazon DSP builds pre-event demand

- A few technical glitches

Amazon’s own investment in this event as a crucial factor

We all noticed a lot more promotion of the event in our own lives as consumers.

Amazon announced Prime Big Deal Days 21 days before the event this year. In 2022, they gave a mere 16 days notice. Although most brands knew that some kind of event was in the works before that, and could stock up and prepare their paid strategy, consumers didn’t have much advanced notice.

As a result, last year’s event was hamstrung by a lack of awareness. But 2023 was much different.

Emily shares that Amazon packages promoted the event, it was on TV and podcast advertising. Awareness was high in the US.

Joao, located in Portugal but a big US sports fan, also noticed a lot more publicity about the event in Europe.

With more consumers aware of the event, there was more pre-event traffic and consideration occurring (which can temporarily hurt your advertising efficiency and dampen sales), but ultimately a much bigger event. Amazon confirmed in a statement that the event was larger than last year’s.

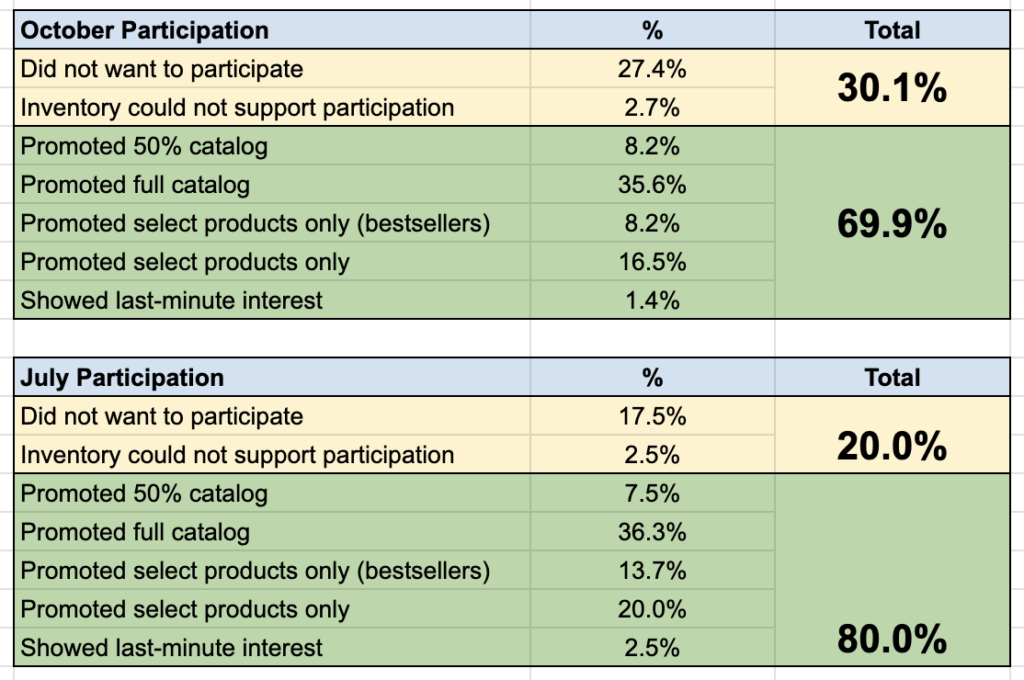

Brands participated slightly less in deals and discounts vs Summer Prime Day

We always track the participation of our clients’ participation in discounts and promotions, as it is always a strong contributor to results on the day.

Comparing the July Prime event to the October Prime Big Deal Days event, we saw slightly less participation from our clients.

While we wait for the final numbers to settle, we don’t yet know how much the non-participants under-performed their more promotional counterparts, but will share that data in our next newsletter (make sure you subscribe here!)

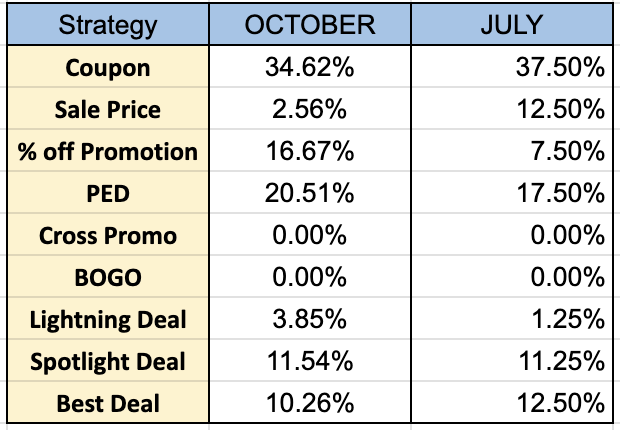

Coupons and Prime Exclusive Deals were the most popular type of discount

Prime Exclusive Discounts and Coupons are the most visible types of promotions in search results, and we favor these in our recommendations to clients.

Prime Exclusive Deals show up prominently in search results, as well as within most types of ads.

CPCs for Sponsored Brand Ads went through the roof (the importance of being responsive)

Emily shared that CPCs (cost-per-click) for Sponsored Brand ad types skyrocketed during the event. We have seen this trend in prior years, and were ready to react if this played out.

Sponsored Brand ads are terrific at driving awareness and consideration, and we rely on them heavily leading up to the event.

Emily noticed around 10AM of the first day that CPCs for one home goods client had skyrocketed from the brand’s average of $2.50 throughout the year, up to $8 or $9. That’s when she re-directed that ad budget to Sponsored Product ads, where the CPCs were more stable and we were still seeing good conversions.

While not unexpected, the sharp ramp in CPCs was unusual. This underscores the need to be nimble and react quickly during such a high-traffic event.

Conquesting more aggressive than ever

Emily shares how she saw success in targeting competitor branded terms and ASINs for a brand in the kitchen category. But that tactic can also be used by your own competitors.

By keeping close tabs on which competitors were targeting her clients’ top ASINs and brand terms, Emily could initiate brand defense campaigns to combat the conquesting.

As a competitive event, savvy advertisers are out there, being as scrappy as possible in acquiring traffic. Again, this underscores the need to be watching closely and responding to market dynamics as the day unfolds.

Amazon DSP builds pre-event demand

Another retail media manager, Robert Benlloch, shared a good news story for a client in the supplements category who had significantly increased ad spend, primarily in top-of-funnel DSP advertising, conquesting campaigns, and ranking campaigns.

This incremental investment resulted in the brand having a dominant SOV (share of voice) for the most important keywords in their market. This competitive position played out extremely well on Prime Day, as the brand was “already on third base.”

- Last PD compared to 2022 October PD:

-

- Ad Spend: $5,096 / $1,835 = +177%

- Ad Sales: $25,598 / $14,000 = +82%

- ACOS: 19.9% / 13.2% = +50%

- DSP spend: $969 / $597 = +62%

- Total sales: $59,056 / $30,899 = +91%

- TACOS: 10.2% / 7.8% = +30%

A few technical glitches

We have shared previously how big events like this can be taken down by glitches and reporting outages. (Read my Forbes post: Amazon Prime Day Bloopers And Glitches: 6 Lessons Brands Can’t Ignore)

While there was not a serious outage or issue that lasted hours at a time, there were short periods where the promotions dashboard was unavailable. One of our tech partners noted that data was flowing slower from Amazon than usual. And as of today (Friday) we don’t yet have VC sales data available for the second day, whereas the data set was complete in the same timeframe last year.

That’s it for this year’s Fall Prime Big Deal Days Event. Make sure you subscribe to our newsletter to see more data as it comes out, and how we’ll be preparing for Black Friday/Cyber Monday.

Kiri Masters, Head of Retail Marketplace Strategy at Acadia

With contributions from Emily Ostrander (Retail Media Manager) and Joao Couceiro (Retail Marketplaces Account Manager)