✍️ Tamara Vukovic is a Retail Marketplaces Account Operations Manager at Acadia.

Amazon’s 2026 fee updates take effect on January 15, bringing another round of FBA and referral fee adjustments.

While the average increase is modest, the real impact comes from various non-standard FBA fees including new inbound defect fees, low-inventory surcharges, dimensional weight rules, and region-based AWD pricing, which together could significantly shift operating costs.

These changes arrive amid rising ad costs, unpredictable freight rates, and cautious consumer spending, making profitability tougher to maintain.

Amazon says the updates reflect “cost alignment,” tying fees more closely to real logistics and warehousing costs - putting the spotlight on margin management, inventory control, and packaging efficiency.

On the bright side, Amazon is also expanding its analytics and AI tools - including profit dashboards and FBA fee previews - to help sellers adjust quickly and make smarter decisions.

In this recap, we’ll break down what’s changing, the real impact on your business, which tools can help you evaluate risk and opportunity, and the key actions to take before the new structure goes live.

Overall Shift: Small Increases, More Granularity

Amazon announced that FBA fees will rise by an average of just $0.08 per unit sold, representing less than 0.5% of the average item’s selling price. This modest adjustment applies across all categories, including apparel, non-apparel, dangerous goods, and low-priced items.

This is on top of zero increases in US referral and FBA fees in 2025.

In addition, Amazon is introducing greater granularity across fee structures; refining fee tiers, weight bands, inbound placement, aged inventory charges, and other related costs to better align with “underlying costs” and service levels.

Key Fee Changes

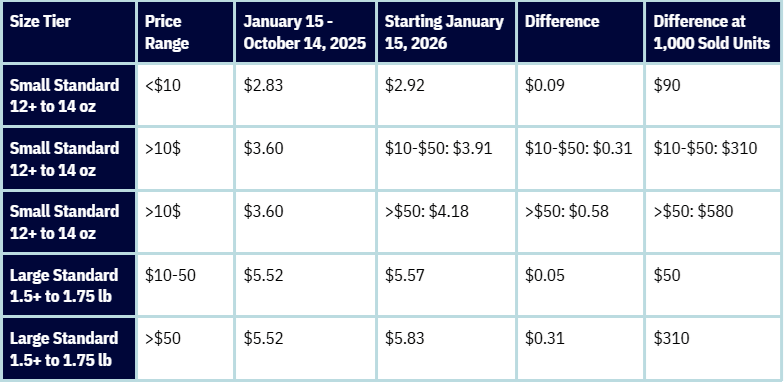

Standard-Size Products Priced $10-$50

- Small standard-size products will see a $0.25 per unit increase (on average) in fulfillment fees.

- Large standard-size products will see a smaller increase of $0.05 per unit on average.

Standard-Size Products Priced Below $10

- For small standard-size items under $10, Amazon is introducing a discount of $0.86 per unit (this is greater than the previous $0.77 discount) compared to standard-size items priced ≥ $10.

- For large standard-size items under $10, the fee remains unchanged.

Standard-Size Products Priced Above $50

- Will see fulfillment fees increase by $0.31 per unit on average.

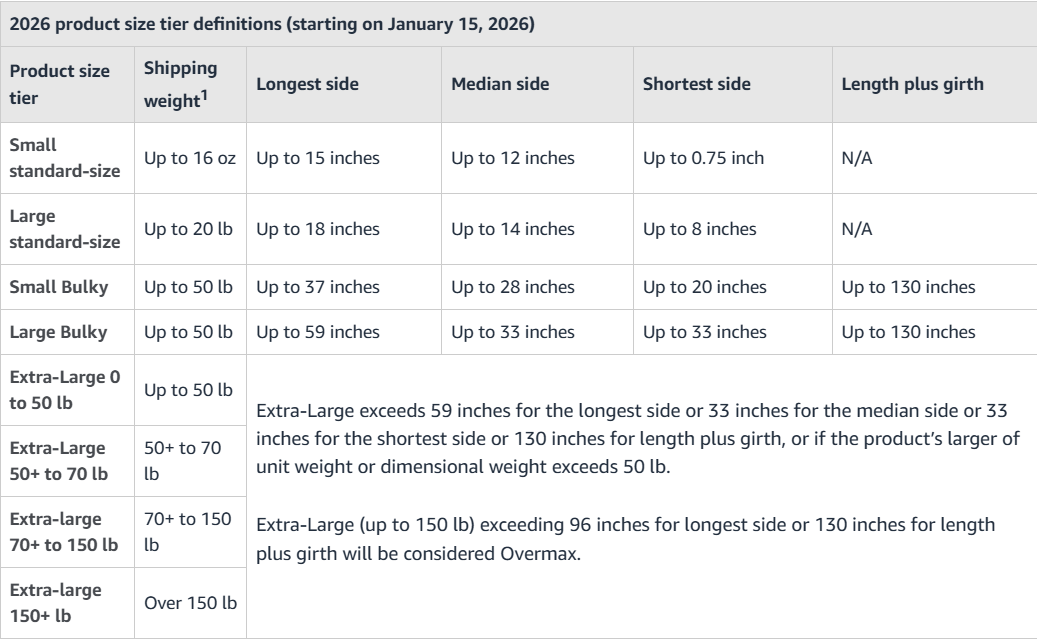

Large Standard, Small Bulky, Large Bulky, and Extra-Large Units

- Amazon will calculate fees using the greater of dimensional or unit weight, a change that may raise costs for lightweight but bulky items.

🔗 Check the updated rate cards and run SKU-level landed cost models ahead of Q1 2026. The “average increase” won’t necessarily match your real-world numbers.

Example:

Non-Peak Fulfillment Fees (Excluding Apparel):

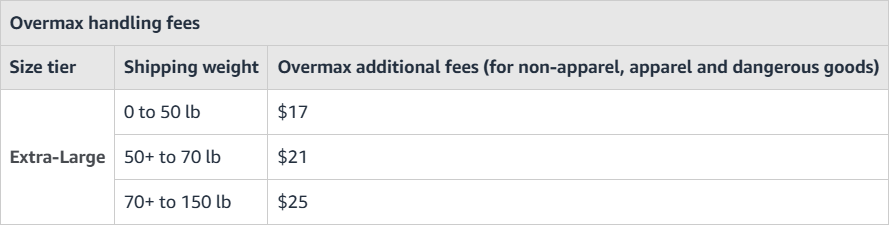

Overmax Handling Fee

- Even though it was announced that there will be no new fees, starting January 25, 2026 Amazon will implement Overmax handling fee; a surcharge on Extra-Large products (up to 150 lb) that exceed 96 inches in their longest side or 130 inches in length plus girth.

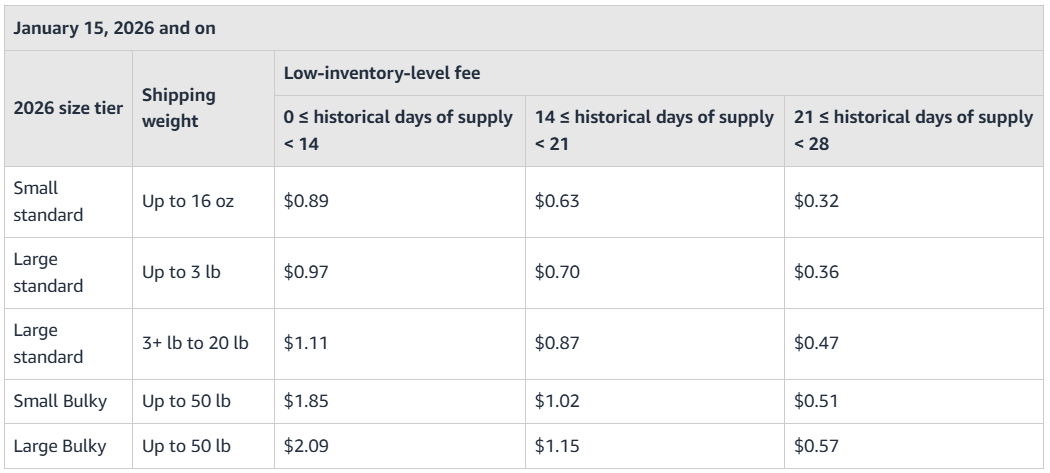

Low-Inventory-Level Fees

- Will apply at the FNSKU level instead of parent-ASIN level. This change ensures that only seller-FNSKUs with historical days of supply that are below 28 days will incur the fee.

💡 This encourages consistent replenishment and penalizes stockouts that force inefficient restocking. For sellers, this means that even products that sell well can quietly erode profit if stock levels dip below Amazon’s target coverage window.

While low-inventory-level fees had previously only applied to standard size items, they will nowl apply for Small Bulky and Large Bulky products going forward. Items under the Grocery category will be exempt.

Slower moving items will also remain exempt from low-inventory-level fees, but they may see slower delivery promises or limited nationwide availability.

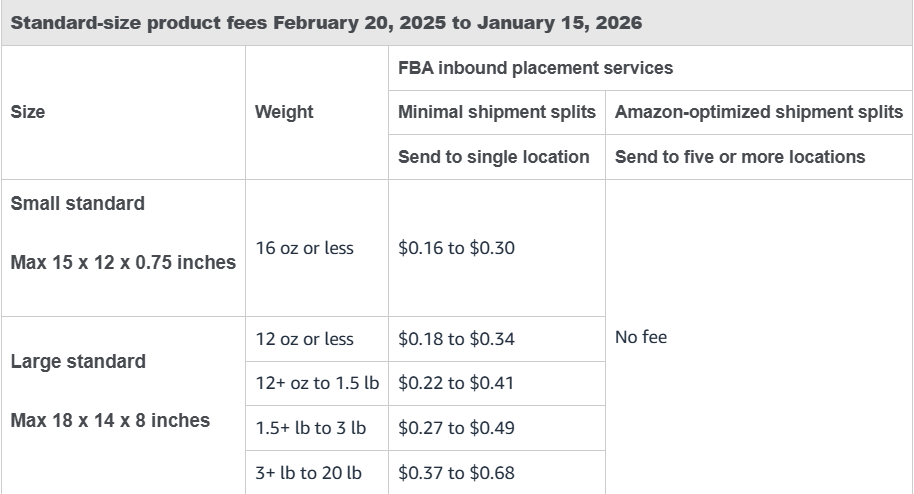

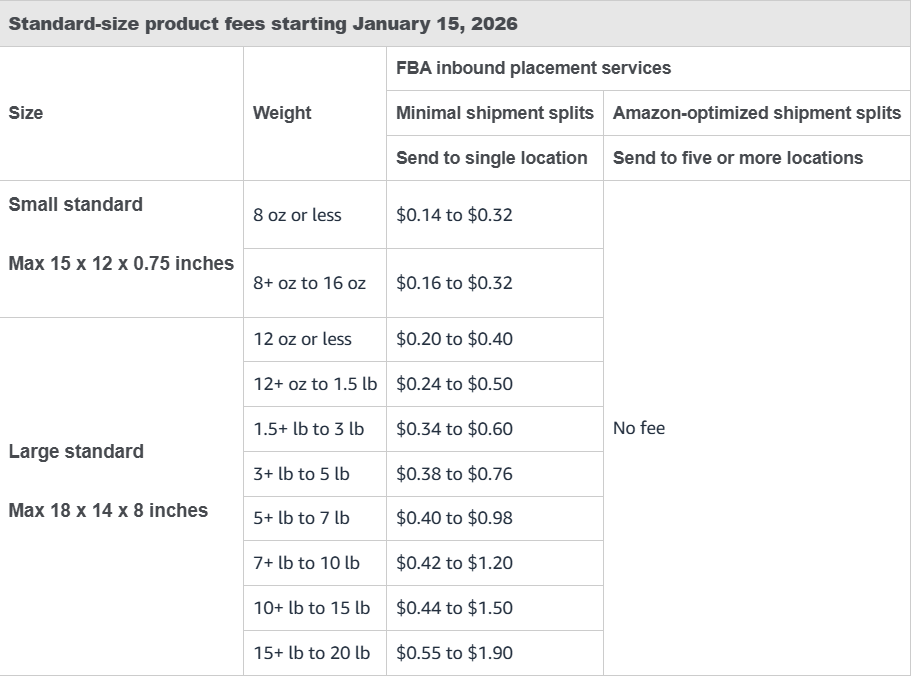

Inbound (Placement) & Shipment Changes

🔗 Check the full rate card here.

- The inbound placement service fee for standard-size products will increase by $0.05 per unit on average (for minimal split shipments).

- Large standard-size products (3-20 lb) will have five new shipping weight bands, increasing granularity.

- The Large Bulky size tier is being split into Small and Large Bulky, and the minimal shipment split fee for the new Large Bulky group will increase by about $0.27 per unit (on average) for minimal split options.

- A packaging service fee averaging $2.07 per unit is introduced for small/large bulky items not eligible for SIPP. For bulky items already using SIPP (Amazon’s shipment-optimization), most will see net fee decreases (on average, small bulky down ~$2.06, large bulky down ~$0.26).

- Shipments that do not arrive, are late (abandoned), or are delivered to the wrong location will now be charged a single inbound defect fee of $0.60 per unit on average. Previously, these shipments would be charged both inbound placement service fees and inbound defect fees.

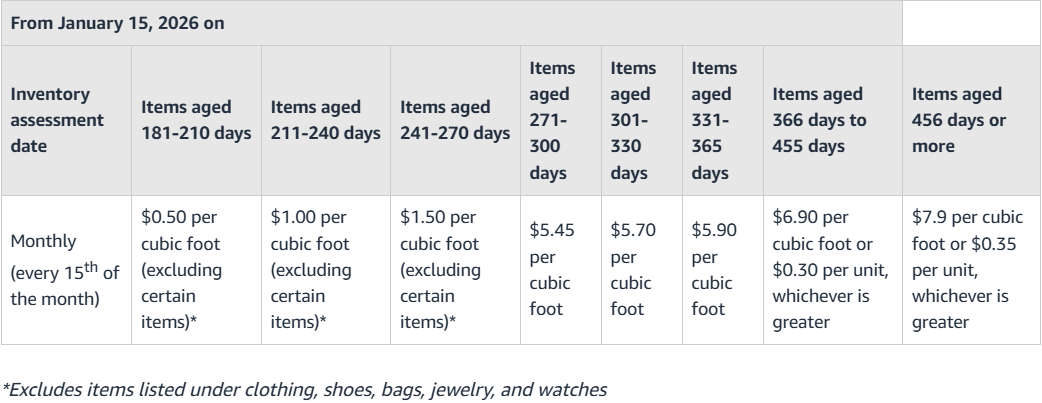

Aged Inventory / Long-Term Storage

- Items aged 12-15 months: the minimum aged inventory fee will increase from $0.15 to $0.30 per unit per month (or cubic foot rates if applicable).

- Items over 15 months: a new aged inventory fee tier of $0.35 per unit or $7.90 per cubic foot, whichever is greater.

💡 This is Amazon’s way of telling sellers: “Move your inventory or pay for the shelf space”. Holding 10,000 aged units could now cost you $3,000/month instead of $1,500. The liquidation option helps offset some losses - you might recover 20–40% of retail value while freeing storage capacity - but it also means sellers must forecast smarter and plan removals earlier.

Removal / Disposal / Liquidation Fees

- For standard-size aged items < 0.5 lb these fees will be reduced by $0.20 per unit, to encourage timely removal of slow stock.

- A 15% liquidation referral fee will apply, based on the item’s gross recovery value.

- A liquidation processing fee will also apply, based on size/weight.

Return Processing Fees

- Previously, Amazon charged a Return Processing Fee for every product that was sent back. Under the new policy, the fee will apply only if a product’s return rate exceeds the category’s set threshold. This means that sellers with consistently low return rates will no longer be charged per return, resulting in meaningful cost savings.

💡 This can be seen as a reward for good listing hygiene - if sellers have a low return rate, they will effectively stop paying per-return fees.

Ships in Product Packaging (SIPP)

- Standard-size products certified as SIPP will automatically receive lowered FBA fulfillment fees on each certified unit shipped.

- For Small Bulky and Large Bulky items, since most products now ship in their own packaging, Amazon will replace the SIPP discount with a lower fulfillment fee for SIPP items.

- Bulky products that can’t ship in their own packaging will incur a packaging fee.

Beyond Fulfillment

Amazon is adjusting several other fees that sellers should be aware of:

Coupons Variable Fees

- Will be capped at $2000 per coupon, effective for coupons created on or after November 5, 2025. This change will be implemented ahead of Black Friday and Cyber Monday to provide more predictability in holiday campaign planning.

AWD (Amazon Warehousing & Distribution)

- West region storage and transportation fees will increase while Smart Storage and Amazon Managed Service discounts will continue.

💡Brands storing bulk inventory in the West region will see an ~19% increase in monthly storage costs.

Example:

Storing 2,000 ft³ in AWD West now costs $1,140/month instead of $960 - a $180/month increase. It’s crucial to reassess where your inventory sits and whether AWD remains the best value compared to traditional FBA or 3PL warehousing. Consider moving inventory from West region and use Smart or Managed Storage to save up to 20%.

Multi-Channel Fulfillment (MCF) Fulfillment Fees

- Will increase on average by $0.30 per unit.

💡 This change subtly penalizes small-basket orders while rewarding volume. If your DTC integration sends 500 MCF orders/month averaging 1.5 units, expect an additional $150/month in fees. However, multi-unit bundles or cart-size incentives can neutralize that cost entirely.

Buy With Prime Fulfillment Fees

- Will increase on average by $0.24 per unit.

From Subsidizing to Monetizing

These programs have been around for a while - initially offered at introductory or discounted rates to drive adoption. Over time, they’ve become more sophisticated, widely used, and integrated into Amazon’s fulfillment ecosystem.

Now that sellers rely on them, Amazon is shifting from subsidizing to monetizing these services. In other words, what started as a way to attract participation has evolved into a profit center for Amazon. The new 2026 rate updates reflect that maturity: fees are higher, but so is the operational efficiency Amazon delivers through them.

At the same time, Amazon is rewarding scale and efficiency. The pricing structure increasingly favors bulk shipments and optimized inventory flows over fragmented or frequent small replenishments. Sellers who consolidate shipments and plan inventory more strategically will benefit most under these models.

On top of that, Amazon announced that they will no longer do prep and labeling for sellers indicating they’re prioritizing operational efficiencies during inbound. Seems that 2026 is the year when Amazon’s expectations from the sellers are reaching their peak.

⚠️ Other Fees

Referral, Base monthly storage, Storage utilization surcharge, Unplanned service, FBA manual processing etc. fees will remain unchanged until further notice.

Impacts & Risks: What Sellers Should Watch Closely

Amazon’s push to better align fees with costs is part of a broader trend: increasing transparency, more weight/size granularity, and encouraging more efficient behaviors (e.g. better packaging, smarter inbound planning).

These changes are not huge in raw average terms, but depending on product mix, scale, and margin buffer, they can meaningfully affect profits.

Here are some of the likely pain points and strategic risks:

1) Margin Erosion on Already Low-Margin SKUs: The increase in fulfillment fees, especially on standard-size items, will put pressure on margins unless sellers adjust pricing or reduce operational waste. Products with tight margins, especially in the $10-$50 bracket or low-priced small standard items, will feel the increase more sharply. A $0.25 per-unit increase is significant if your margin buffer is small.

2) Slower-Moving Skus Become “Loss Traps”: The heightened aggressive aged inventory penalties make it costlier to carry stock that doesn’t sell. Holding inventory for 12+ months is now more punitive.

3) Bulky Items at Risk: The changes in the bulky/oversize tiers show Amazon is trying to rationalize costs for heavy, voluminous products; sellers with a large number of bulky SKUs will need to recalculate profitability carefully and/or consider FBM.

4) Complexity & Forecasting Risk: With more tiers, weight bands, and exceptions (SIPP, packaging service, liquidation fees), fee calculations become more complex. Misforecasting or misclassification could lead to underestimating costs.

5) Increased Pressure on Operational Efficiency: Everything from packaging, labeling, inbound shipment design, packing density, product bundling, and supply chain logistics will need tighter control.

6) Potential Pricing Backlash or Competitiveness Challenges: Raising prices to absorb fee changes can push sellers into competitive disadvantage, especially in commoditized categories.

7) Cash Flow Timing & Buffer Risks: If demand softens but fees and penalties grow, cash flow stress could emerge, especially for smaller sellers or newcomers.

The Upside:

- If Amazon’s promises of improved forecasting, inventory placement, and automation deliver, sellers might see better in-stock performance, faster delivery, and perhaps lower lost sales.

- The fee discount on < $10 items (i.e. the $0.86 discount) may benefit sellers focused on very low-price goods (if the volume can absorb the discount).

- Some bulky sellers might gain from net decreases if their SKU mix already optimizes use of SIPP.

Recommended Actions for Sellers Heading Toward 2026

💡 DOWNLOAD YOUR CHECKLIST

Access actionable tips from Acadia's team of experts.

2026 Updates to Canada Referral and FBA Fees

No Fee Increases in 2026

Amazon announced that Canada referral and FBA fees will remain unchanged for 2026, following ongoing investments in faster delivery and operational efficiency.

New Seller Benefits

Effective Nov 5, 2025:

- Coupon fees will be capped at CAD 500 per coupon, reducing promotion costs

- A new FBA Liquidations program will help sellers recover value from excess or returned stock, with a 15% referral fee plus a CAD 0.25-1.90 processing fee (and +CAD 0.20/kg for items over 5 kg).

- Improved tools for profitability: Amazon is introducing enhanced analytics - including the Revenue Calculator, Fee & Economics Preview, and the new Profit Analytics dashboard - to help sellers track unit economics and understand how changes affect their margins.

The Bottom Line

Amazon’s 2026 fee updates may appear minor on paper, but their strategic impact is far-reaching.

The real impact will depend heavily on your product mix, pricing flexibility, supply chain efficiency, and inventory discipline.

For sellers with tight margins or many slow-moving SKUs, even small fee increases and harsher age penalties can move borderline products into loss territory.

On the flip side, sellers who proactively model these changes, optimize their operations, and reallocate resources may maintain or even improve profitability.

- Don’t ignore these updates just because the “average” increase is small - your most vulnerable SKUs will tell a different story.

- Use this as a forcing function to clean up your catalog, optimize processes, and double down on higher-margin SKUs.

- Leverage tools and simulations now to avoid nasty surprises come Jan 15, 2026.

- Be agile: monitor Amazon’s further refinements and adjust your playbook as new details surface.

Gain the Advantage

With Acadia’s “Revenue Defender” and forward-looking strategy, sellers can stay ahead of these changes.

We keep our strategy fluid: when net profit changes, strategy changes as well - connect with our experts to find out more.