As we unpack the frenzy of Black Friday and Cyber Monday (BFCM), I’m excited to share some insights and strategies that not only led to incredible sales for our clients but also highlighted the importance of acting early and smartly managing advertising budgets.

In this post I’ll unpack:

- Why BFCM is far more than a 4-day event

- Relying on ‘tried and tested’ advertising strategies, versus new shiny capabilities

- Beyond day-parting to an “hour parting” approach with Amazon ads

- One technical snafu - thankfully a minor one!

My colleague Damiano Ciarrocchi, Retail Media Manager at Acadia, contributed advertising-related insights to this post.

Black Friday/Cyber Monday is actually month-long event

Something our team has consistently observed is that the BFCM event isn't limited to the days named in its title. And this year, Amazon leant into an overall retail trend of holiday shopping starting earlier and earlier, re-branding the event as “Turkey 11”. Some of us were unsure if shoppers would embrace the earlier deals, or stick to similar shopping patterns of T5 as they are not "educated" on this longer promotional event. But overall we saw sales picking up much earlier than in past years.

In fact, the approach we took for one of our apparel clients this year demonstrates the benefits of extending promotional efforts well before the traditional shopping period. Starting as early as October, this client ramped up their advertising strategies and promotions and we focused on not just the event itself, but the entire lead-up period. The planning for this strategy started back at the start of 2023, with a detailed promotion calendar that includes: discount type, discount amount, budget, associated fees, which ASINs are targeted, and ad spend. We then track performance in terms of redemptions, clips, PPC performance, and actual sales.

This approach of kicking off early paid dividends for this client, who surpassed 2022’s event by 36%.

The decision was to leverage the visibility boost provided by the algorithms during the heightened traffic of fall’s Prime Day and what we call the Turkey 5 (the five consecutive days starting with Thanksgiving and ending with Cyber Monday).

This approach resulted in a remarkable 36% sales uplift from the previous year. The early promotions paid dividends – leading to an increase in page views, conversion rates, and culminating in our client reaching the top seller mark at number 10 on Amazon’s Best Seller Rank (BSR) for the first time.

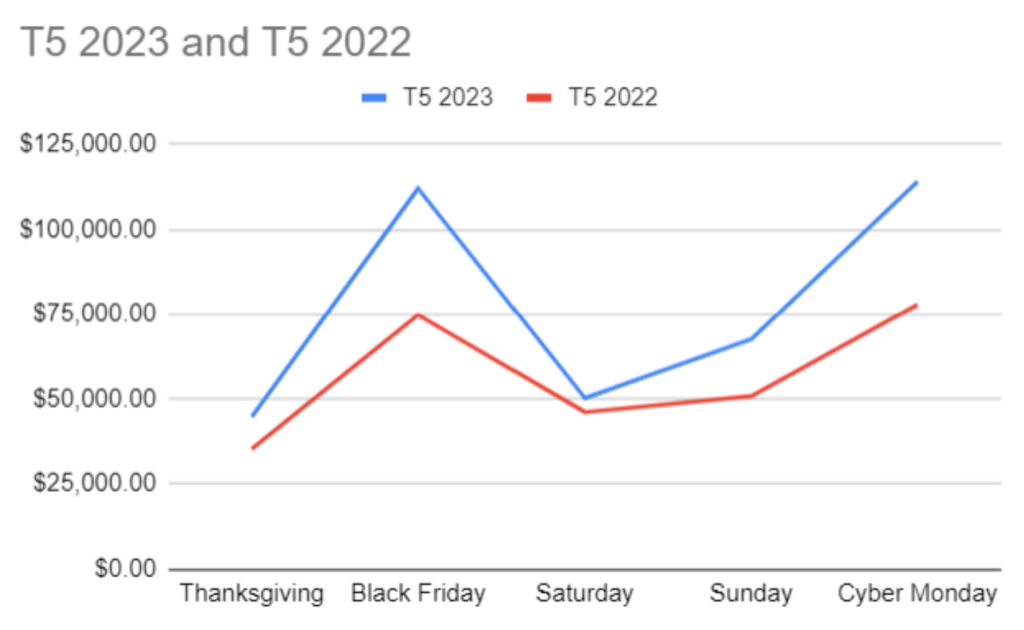

Looking at the shopping event itself, we noticed some interesting patterns across our client base. In terms of sales performance, we observed that Black Friday outperformed Cyber Monday significantly, confirming a shift in consumer spending behavior. While Black Friday always has been the star, we saw some of our clients' sales on this day reach up to 80% higher than the next best day. Contrary to expectation, Sunday sales were tracking upwards, with Saturday experiencing the least action. It seems that after the spending spree of Black Friday and the community support-driven Small Business Saturday, there's a bit of shopper fatigue before the final push of Cyber Monday.

One (minor) technical snafu

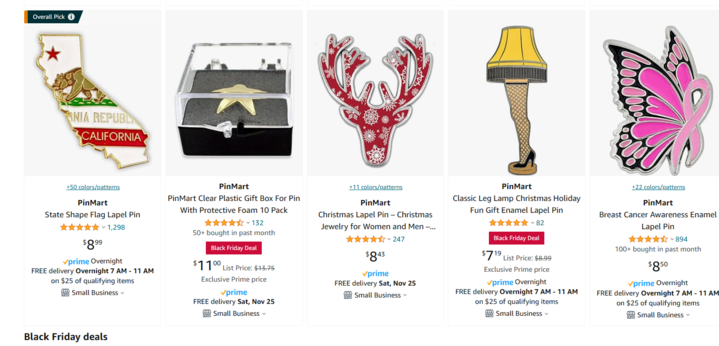

Not sure if this would change next year, but this year this was the case. Also, to be given this badge, you need to check the BFCM check box while creating the PED in the backend.

Even the best-laid plans can encounter snags though. One such hiccup we encountered involved Prime Exclusive Deals (PEDs). When setting up deals, we learned you must select a specific option for the badge to display "Black Friday/Cyber Monday Deal." We realized we had to retrace our steps to ensure that these tags were correctly displayed – a crucial detail that significantly impacts visibility and consumer trust.

PEDs are much more visible on product detail pages during this event, as only with this type of discount are you allowed to be given the Black Friday/Cyber Monday Deal Badge.

Beyond day-parting to an “hour parting” approach with Amazon ads

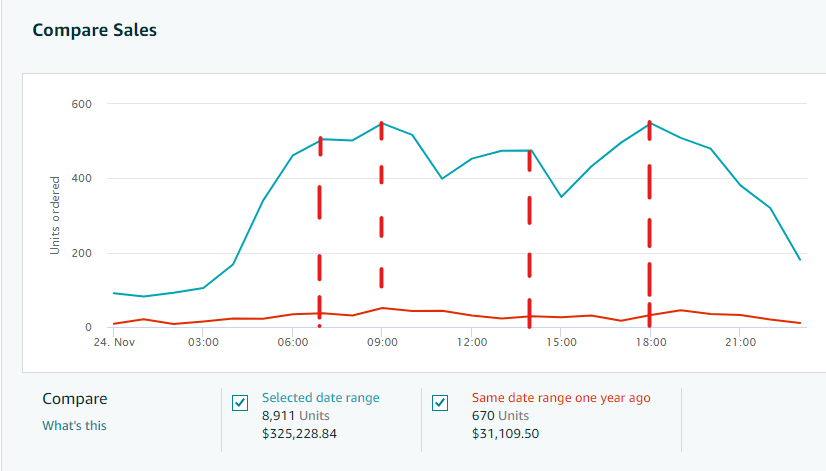

My colleague Damiano Ciarrochi is a retail media manager at Acadia. He shares that managing an advertising budget across the Turkey 5 required a spread rather than a focus, contrasted with Prime Day where the promotional activities are centrally concentrated on Amazon. Though some clients opted for slightly lower budgets during BFCM compared to Prime Day, we noticed that the strategy to spread out the ad spend across more days was still immensely effective.

One particular tactic that proved successful was agile budget management. Thanks to Damiano’s vigilance, our clients didn't miss out on peak shopping hours. For instance, with a client in the beauty category, we preemptively increased their ad budget just before their busiest hours. By analyzing historical data to predict sales peaks, Damiano was able to re-up ad spend 30 to 40 minutes before these busy times, ensuring constant visibility without overspending.

Relying on “tried and true” ad tactics, or test out the shiny new gear?

What about new advertising features? Amidst the array of tools and ad types Amazon rolled out over the year, one that stood out was the Sponsored TV ads introduced in late October. However, its freshness and lack of historic data meant we approached this feature cautiously for such a high stakes event.

Unlike Prime Day or Prime Big Deals Day, our clients weren’t purely focused on their Amazon sales channel during BFCM. The ad budget had to be spread around to other retailers and often a brand’s DTC site too. So we are not just competing against other brands on Amazon, but against every DTC site and retailer. This made sticking to tried-and-tested ad strategies more attractive. Experimentation can wait for a lower-stakes moment.

Remember, every day here on out is a peak selling day

As we look towards the end of the year, it's essential to remember that every day leading up to December 21 is still invaluable. The lessons we've learned can be applied daily to maintain a competitive edge throughout the holiday shopping season. However, it's not just about being aggressive with sales; it's also about being meticulous with your advertising spend to ensure optimal returns on investment.

Damiano notes that the whole of Q4 sees a vast increase in the number of impressions overall. Across his book of clients, Damiano has seen impressions up 45% and clicks up 83%, versus the other days of the year. This means that every selling day in Q4 can offer a great “bang for your buck” in terms of advertising, and any other tactic you can use (such as enhancing your brand and product content) to boost consideration on your product pages.

It was inspiring to see many of our clients hitting their year-end goals over the BFCM weekend. Their success was a testament to the meticulous preparation and strategic execution. It goes to show that with the right approach, BFCM can be more than just a couple of days of heightened sales - it can set the tone for a triumphant end-of-year performance.

Here's to a record-breaking end of the year!

Emily Peterson is a Retail Marketplaces Team Lead at Acadia