Amazon is set to implement several significant changes to its fee structure for sellers on Seller Central, which will impact various aspects of selling on the platform.

This is a common occurance on Amazon – in nearly 8 years supporting brands on Amazon, I have seen my fair share of changes to FBA fees. The 2024 adjustments, however, are harder to digest than usual. I had to re-read the announcement several times in order to fully grok the impact. In this post I will share a summary of the major changes, a timeline for rollout, and also work through some specific cases in order to demonstrate the changes.

You’ll see that there are a few cases where Sellers will see their fees go down, but in the majority of cases, they will be increasing. These changes will start rolling out starting in February 2024, so it’s important that Amazon Sellers get ahead of the changes and understand how it may impact their bottom line.

Amazon will make seven major adjustments to its FBA fee structure in 2024

1. Inbound Placement Service Fee

This is the big change that Sellers will have to wrap their heads around. This new fee is introduced to cover the cost of transporting shipments from an initial receiving center to multiple fulfillment centers across the country. This is not the same as the cost of shipping to Amazon but rather Amazon's internal logistics cost. Sellers will have options to pay reduced or no fees depending on the logistics choices they make, but this fee can be significant, averaging $0.27 per unit for standard-sized products and $1.58 per unit for large bulky-sized products. The fee is effective starting March 1, 2024, and will be charged 45 days after products are received.

Why is Amazon introducing this fee? The fee reflects a shift in Amazon's fulfillment network to a more distributed, regional model with 8 interconnected networks. This means sellers now have to align with Amazon's desired inventory distribution plans instead of sending to just one or a few fulfillment centers.

But the challenge for brands is that there is complexity and lack of control for sellers around the options to reduce fees based on sending inventory to single vs multiple locations. Sellers will only be charged the inbound placement fees 45 days after products are received at Amazon’s initial receiving center, making it hard to know exactly how much this fee will impact a brand for any given shipment. Sellers will have to proactively model total landed costs to make the best financial decisions.

2. FBA Fulfillment Fees Will Reduce

Amazon will lower the Fulfillment by Amazon (FBA) fulfillment fee rates on average, decreasing by $0.20 per unit for standard-sized products and $0.61 per unit for large bulky-sized products. This change is expected to start on April 15, 2024.

Its rare to see an FBA fee reduction, and I guess it is intended to mitigate some of the new costs Sellers will see with the new Inbound Placement Service fee. But there is still a shortfall that Sellers will need to account for.

3. Adjustments to Size Tiers

Size tiers for products are also changing. The small standard-size tier will now have measurement intervals of every 2 ounces, and the large standard-size tier will be measured at intervals of 4 ounces up to 20 lb. The existing small, medium, large, and special oversize tiers will be replaced by new large bulky and extra-large size tiers, starting February 5, 2024.

4. Low-Level Inventory Fee

A low-level inventory fee will be introduced, which will apply if sellers consistently carry low levels of inventory relative to their unit sales. This is aimed at standard size products and is intended to ensure that Amazon maintains a sufficient supply of inventory for fast customer delivery. Brands will need to monitor inventory levels on an item-by-item basis, with the days of cover required by Amazon being four weeks. There are some exceptions to this fee, including for new professional sellers and new-to-FBA products for specified time frames.

There’s another exception, which is for Sellers enrolled in the “Amazon Warehousing and Distribution” program, and those with products auto-replenished by Amazon. My personal opinion here: there seems to be an incentive to start using Amazon logistics programs to get discounts and avoid some of the fees. However, many brands have experienced frustrating mistakes at the hands of Amazon’s logistics programs in the past, so they are unlikely to commit to using such programs until they are proven to work well.

5. Monthly Inventory Storage Fee Changes

Amazon is set to reduce the off-peak monthly inventory storage fees (January-September) by $0.09 per cubic foot for standard-size products, effective April 1, 2024.

6. Ships in Product Packaging (SIPP) Program

This program, previously known as Ships in Own Container (SIOC), will be expanded, providing a fulfillment fee discount for products that can be shipped in their existing packaging. Discounts range from $0.04 to $1.32, and the program will be open to all FBA sellers starting February 5, 2024.

7. Apparel Referral Fee Reduction

This is one of the rare cases where a seller may end up paying less in fees. Amazon will reduce referral fees for apparel products. For items priced under $15, referral fees will be decreased from 17% to 5%. For products priced between $15 and $20, referral fees will go from 17% to 10%. These changes will start on January 15, 2024.

Finally, while not specifically a change to fees, Amazon will add a few perks to the FBA New Selection program, mainly around a slightly increased number of units that qualify for rebates and extended window for storage.

In summary, while there are reductions in areas such as FBA fulfillment fees and referral fees for specific items, the introduction of the inbound placement service fee, low-level inventory fee, and the overhaul of size tiers and monthly storage fees is likely to result in a net increase in costs for most sellers. It will be critical for brands to perform a detailed analysis of these changes to understand their impact and adjust their selling strategies accordingly.

Let’s work through a few examples to see.

How the new FBA fees will impact sellers: 3 examples

Based on the provided document sources, here are 2-3 examples illustrating how the new Amazon fees will impact brands with varying price points and sizes:

Example 1: A Toy Brand with a $40 Product in a Large Standard Size

- Product weight: 2.5 pounds

- Yearly sales on Amazon: $5 million

- Impact of inbound placement fee: If one-third of the shipped inventory is affected by the new fee, this could be approximately 42,000 units incurring a fee of around $0.40 each. This amounts to almost $17,000 in fees per year for this inbound placement service.

- Impact of reduction in FBA fees: (mitigated) ~ $6,000 less

- Net impact: ~ $11,000 more

Example 2. A CPG Brand Selling a $12 Item in Small Standard Size:

- Product specifics: $12 item, small standard size

- Yearly sales on Amazon: $5 million

- Impact of inbound placement fee: Assuming the CPG brand sells around 140,000 units (a third of the total) that are charged an inbound placement fee of around $0.25 each, this translates to almost $35,000 in fees per year for the brand.

- Impact of reduction in FBA fees: (mitigated) ~ $21,000 less

- Net impact: ~ $14,000 more

Example 3. A Furniture Brand Selling a $150 Chair in Large Bulky Size:

- Product weight: 20 pounds

- Estimated number of units affected: 11,000 (a third of the total)

- Impact of inbound placement fee: Assuming an estimated inbound placement fee of around $3.50 each for the affected units, this could mean nearly $39,000 in fees per year for the furniture brand.

- Impact of reduction in FBA fees: (mitigated) ~ $30,000 less

- Net impact: ~ $9,000 more

Note: large bulky products in particular could benefit from SIPP. If this brand enrolled in SIPP, they could save ~ $43,000 in fees.

These scenarios give a glimpse into how brands of different sizes and price points will encounter an uptick in costs due to the new inbound placement fee. High volume but lower average selling price (ASP) products could see a significant impact given the fee's per-unit basis, which means that the more units a brand sells, the more they will have to pay in fees if a significant proportion of their inventory is affected by the fee.

The introduction of these fees may prompt some brands to re-evaluate their fulfillment strategies, possibly even leading them to consider switching to Fulfillment by Merchant (FBM) or looking into Amazon's logistics programs to mitigate some of these costs. However, as I already mentioned, Amazon's existing programs have their own complexities and potential for mistakes, so brands will need to weigh these options carefully.

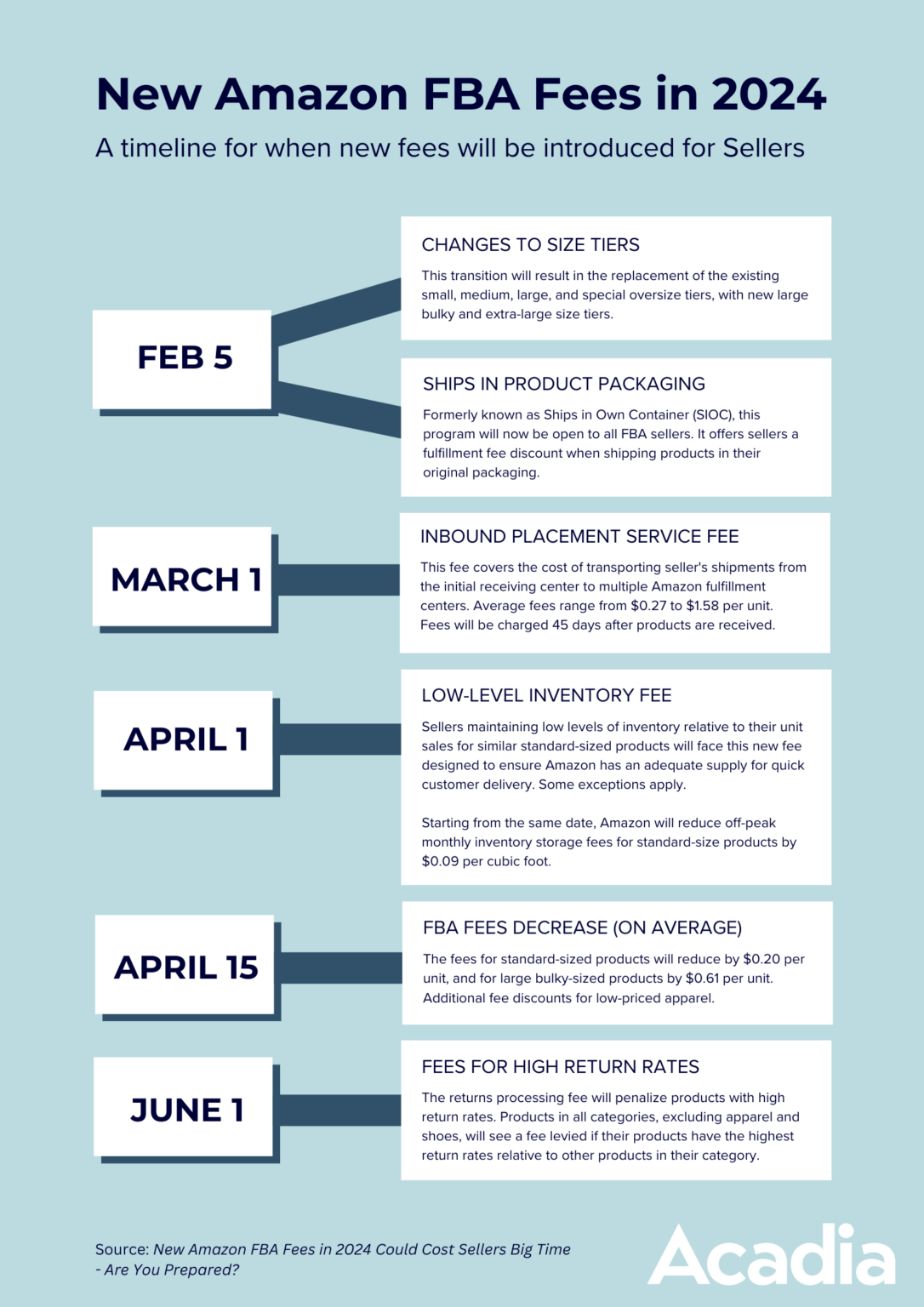

Rollout timeline for new Amazon fees in 2024

The upcoming changes to Amazon's fee structure for sellers on Seller Central are scheduled to roll out on multiple dates throughout 2024. Here's a timeline of when the key changes are due to go into effect:

February 5, 2024:

Changes to size tiers will begin. Small standard-size tier measurements will be adjusted to intervals of 2 ounces, and the large standard-size tier will be measured in 4 ounces intervals up to 20 lb. This transition will result in the replacement of the existing small, medium, large, and special oversize tiers with new large bulky and extra-large size tiers.

On the same date, the Ships in Product Packaging (SIPP) program, formerly known as Ships in Own Container (SIOC), will be open to all FBA sellers. This program offers sellers a fulfillment fee discount when shipping products in their original packaging, ranging from $0.04 to $1.32.

March 1, 2024:

The new inbound placement service fee will take effect. This fee covers the cost of transporting seller's shipments from the initial receiving center to multiple Amazon fulfillment centers. The average fees will be $0.27 per unit for standard-sized products and $1.58 per unit for large bulky-sized products. Sellers will start being charged the inbound placement fees 45 days after products are received at Amazon’s initial receiving center.

April 1, 2024:

The implementation of the low-level inventory fee begins. Sellers maintaining low levels of inventory relative to their unit sales for standard-sized products will face this new fee designed to ensure Amazon has an adequate supply for quick customer delivery. Exceptions to this fee include new professional sellers for the first 365 days after the initial inventory-received date, new-to-FBA products for the first 180 days, and products auto-replenished by Amazon Warehousing and Distribution.

On the same date, Amazon will reduce off-peak monthly inventory storage fees for standard-size products by $0.09 per cubic foot.

April 15, 2024:

Fulfillment by Amazon (FBA) fulfillment fee rates will decrease on average. The fees for standard-sized products will reduce by $0.20 per unit, and for large bulky-sized products by $0.61 per unit.

Additionally, for apparel products priced below $20, Amazon will start offering reduced referral fees on January 15, 2024. For items priced under $15, fees will decrease from 17% to 5%, and for products priced between $15 and $20, fees will decrease from 17% to 10%.

June 1, 2024:

The returns processing fee will penalize products with high return rates. Products in all categories, excluding apparel and shoes, will see a fee levied if their products have the highest return rates relative to other products in their category.

In conclusion: get organized

These changes are designed to reflect Amazon's costs of distributing inventory, expedite delivery times, and motivate sellers to maintain appropriate stock levels. At face value, these updates make sense for Amazon (and shareholders).

But for sellers, it can be tricky to navigate yet another change. At Acadia, we will be helping our Amazon Full Channel Management clients to work through the implications of these changes in the coming months. These changes are likely to require re-assessing your pricing structure, discounting strategy, and retail media spend.

There are various paths to mitigating these fee increases, such as the Ships in Product Packaging program, but these come with effort, so the planning must start now! If your brand would benefit from support in 2024, reach out to us. Or, subscribe to our newsletter to stay up-to-date on all the best practices and commentary fro our retail marketplaces team.

Armin Alispahic is a Retail Marketplaces Team Lead at Acadia.