A program released this summer called Amazon Insights is meant to enable sellers to survey customers about why they buy—or don’t buy—certain products. It’s basically a quick means of creating a one-question survey to see where product marketing works and where it doesn’t.

If you’ve never heard of this new tool, you’re not alone; few brands have used Insights so far, and Amazon’s done very little to promote it. Since the feature is still brand new, it’s entirely possible that Amazon is still working out exactly how to implement and improve upon it. If that’s true, let’s hope the fee structure is on Amazon’s troubleshooting to do list; in its current form, Insights charges a pretty high price for convenient access to each customer response.

Unfortunately, cost might be a deterrent to experimentation, which is the only way sellers are going to get comfortable with the feature. Unless you can manage to formulate the perfect question for extracting the kind of information you want, you might not see the value of trying out Insights.

At a hefty $5 per response, sellers hoping to get quality information for a reasonable investment have to think very carefully about what to ask—so carefully that they may be discouraged from using the feature at all.

Nevertheless, there are some circumstances in which it might make sense to poll a group of customers using Insights. And that’s where we turn our attention in this post.

How Amazon Insights works

Insights is quite simple to use. From within Seller Central, choose your target size—you can select anywhere from 100 to 2,500 respondents—and input the question(s) you’d like to ask them. The standard project is one question; multi-question surveys are done on a custom basis with features that aren’t yet widely available. The kicker is that with a starting price of $5 per response, any data set you receive will cost a minimum of $500, and that’s just for 100 respondents. Beyond those hundred, Amazon will not share any data about the cohort chosen for your sample.

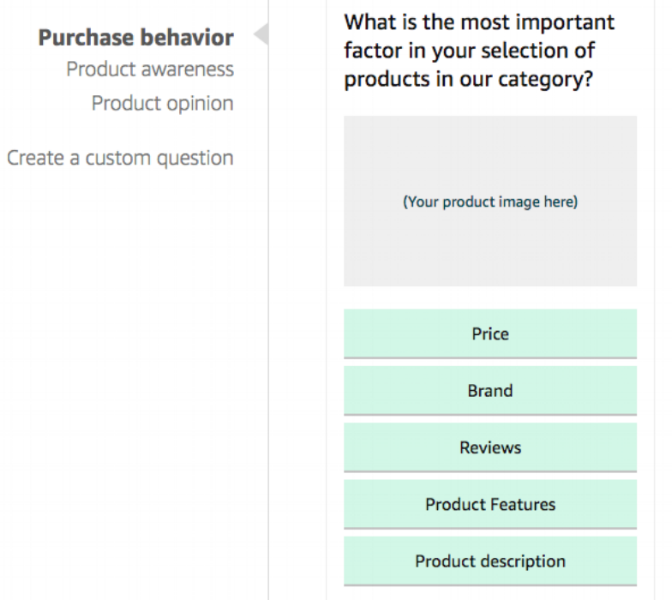

Using the standard questions Amazon makes available isn’t really going to justify the expense. But just as a starting point, let’s take a look at what these boilerplate questions look like. Here’s what you’ll see:

As you can see, each question has five possible answers and the default topics respondents can be asked about are purchase behavior, product awareness, and product opinion. Alternatively, you can choose to create your own question, an approach that is far more likely to get you useful information that warrants the cost of using Insights. Just thoughtfully consider what specific insight or piece of customer feedback could provide the most benefit for your brand, and let that frame the question you ask.

Once you’ve composed your question, Amazon will solicit feedback from four types of respondents:

-

customers who purchased your products

-

customers who viewed your products

-

customers who viewed but did not buy

-

customers who bought something else in the same category on Amazon

Submit your proposed survey project with the desired target size, and Amazon will get back to you within a few days about the specifics. Your final price will depend on factors like the number of actual responses Amazon receives once it begins to ask customers and the total number of customers you’d like to hear from. There doesn’t appear to be any form of bulk discount. Although $5 per response is the standard rate, you could be charged more depending on the complexity of your project proposal. So far, we haven’t heard of Amazon charging any less.

When does using Amazon Insights make sense?

Despite the steep price, there are times when using Insights could actually be a smart move. It really depends on the usefulness of the information you’ll receive. So when would it make sense for your brand to invest in this program?

Let’s say you’re selling a certain product, and you’ve read that bundling products is a good way to get more business. Naturally, you want to figure out which products to bundle. Insights could allow you to ask several hundred customers which other product among five possible answer choices they’d be most likely to purchase.

That could be very useful information as the holidays near and you try to stock up on inventory of just the right items in order to get the most out of the big sales events of late November and the December holiday rush. Knowing what to bundle could be worth the price of a hundred responses from Insights.

Sellers who used Insights also used…

Amazon realizes that gaining momentum with your sales volume can be difficult. Sellers are all too familiar with this Catch-22 situation: It takes some initial volume in order to get more volume. With this in mind, hopefully Amazon will soon bring prices down or possibly expand what’s included as part of each purchased response on Insights. Until then, if the cost of an Insights survey seems justified for your brand, you may find that the tool is a nice addition to the other programs Amazon has recently made available.

This ever-expanding array of tools keeps making it easier for brands to manage their operations on Amazon. Like the Early Reviewer program, which helps get some sales momentum going by securing those crucial first reviews for a recently-launched product, the Insights program makes sellers a very simple offer: Pay Amazon to gather data for you. Using its voluminous customer base to put your product in front of a relevant audience, Amazon will determine what compels those customers to make the decisions they do, which can help you rapidly improve your strategy and jumpstart the process of building sales momentum.

Summary

Maybe you’ve got a new pair of products you’re bundling or a new product you’ve launched, or maybe you’re selling in an unfamiliar category. In cases like these, Insights is a good tool to be aware of because the information that an Insights survey provides might be worth its high price.

The bottom line is that there’s a pricey new tool that lets sellers survey customers about their buying habits (and their non-buying habits). It’s tough to know the decision-making process for a given customer, especially one who decided not to buy, but this tool can improve your understanding of how customers think. Just be sure you ask a question that pinpoints what you really need to know.