Armin Alispahic is the Retail Marketplace Services Lead at Acadia.

Jordan Ripley is the Director of Retail Operations at Acadia.

It’s been a year of change for Amazon sellers, and we’re not out of the woods yet with Q4 storage fees about to come online. The company has spent the past several months overhauling its fee structures, meaning that shipping costs, inventory charges, and distribution markups have all likely impacted sellers’ bottom lines.

It’s not easy for brands to keep up with every change – that’s what Acadia is for.

Here, we post-mortem what fee changes actually went into effect this year, what the impact looked like to brands in the months that followed, and some recommendations to help offset any of these changes in cost structure.

What’s new?

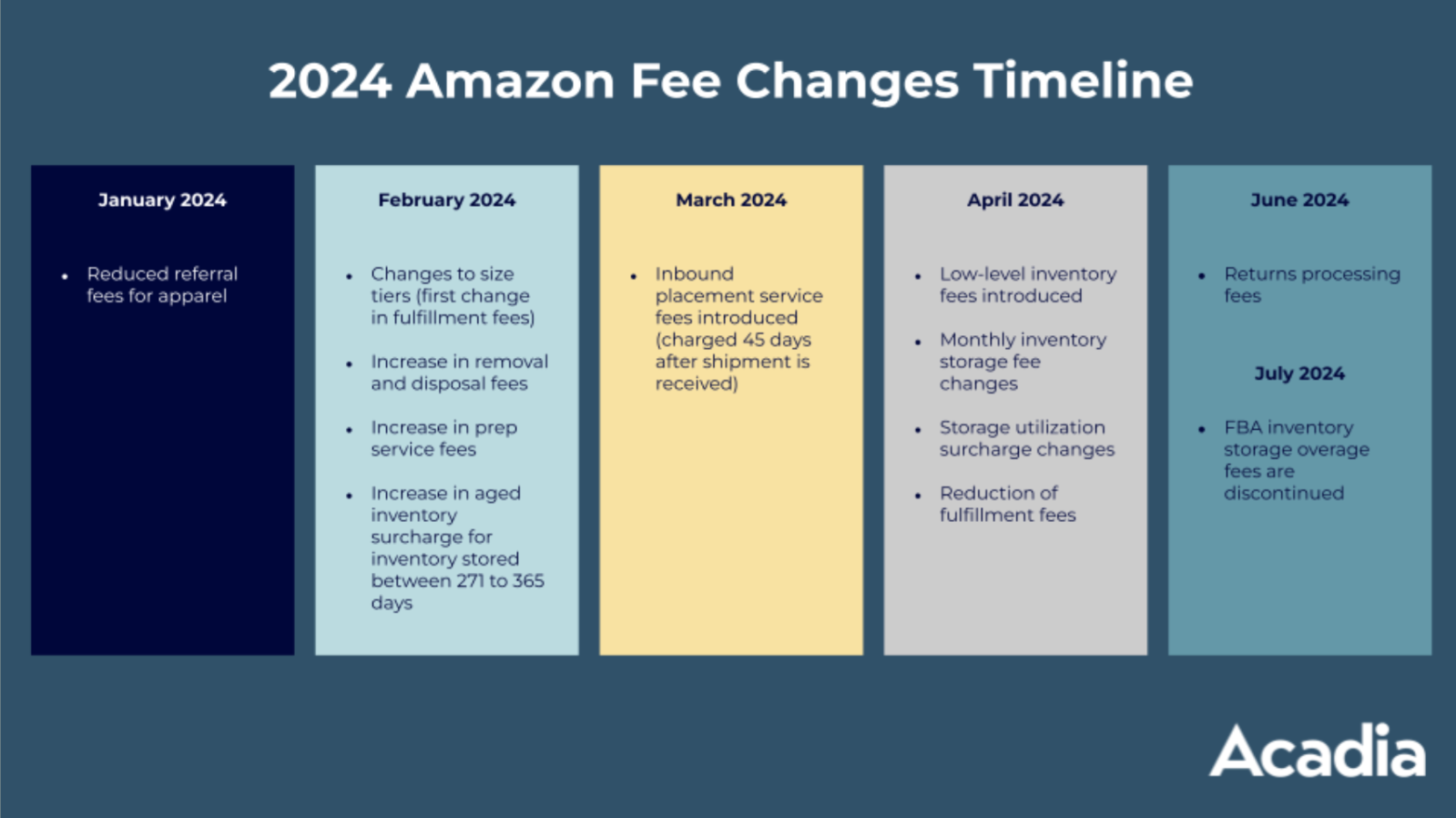

Amazon’s fee changes are not unexpected, but what usually happens is a one-and-done update at the end of the year. In 2024, a series of changes rolled out from January to July – the result of Amazon shifting from a national fulfillment model to a regional one. The goal behind that shift is to have more hubs that can quickly deliver product to the end customer, but with it comes a more complicated structure for sellers. Amazon made adjustments in fulfillment and storage fees, introduced more granular size tiers, reduced referral fees for apparel priced below $20, introduced inbound placement fees, return processing fees and increased removal, disposal and prep service fees as well as aged inventory fees.

Amazon Seller Account Profitability Analysis | The Impact of Fee Changes

Download the PDF to access:

- The Changes Timeline,

- Inbound Costs Analysis Results

- Total Shipping Costs Analysis Results

- Profitability Trends

- Actionable Advice & More

Changes to shipping fees: In addition to paying carrier fees, Amazon has introduced its own inbound placement fees for distributing inventory between warehouses by unit.

Changes to storage fees: Amazon has introduced low-inventory-level fees, meaning it can slap you with charges if you’re not holding enough stock, or if you overstock with storage utilization surcharge. Monthly inventory storage fees for standard-size items have actually gone down while aged inventory surcharge has gone up.

Changes to fulfillment fees: Good news: fulfillment fees have gone down across the board, partially offsetting increases. Important to note that returns processing fee now applies to products that reach the return rate threshold specific to each category.

It sounds like a lot, and it’s certainly a sign that Amazon is seeking to make its fulfillment business more profitable as well as more efficient. Amazon rode the e-commerce boom during Covid, and opened many warehouses across the country – now, those warehouses need to be optimized and used. In a way, Amazon is now solving a problem it created for itself by making changes to the fee structure. But what about the ultimate impact to the brands that leverage Amazon’s fulfillment network? All told, the pricing structure doesn’t mean that all sellers will now be in the red. By understanding what’s changed, sellers can adjust their own shipping models accordingly to maintain profitability.

The Impact

There’s no way to sugarcoat it: inbound fees – meaning placement and carrier fees – have risen.

In an Acadia analysis, inbound costs rose on average 33% for both high-volume sellers (selling more than 40,000 units in the period from April 1 to August 31) and mid-to-low-volume sellers. High-volume accounts saw the biggest change, with a 130% increase in inbound costs compared to the pre-fee change period. Carrier fees (or inbound transportation fees) alone increased by 40%. For brands that specialize in selling larger products – which Amazon calls the “bulky” category – costs will be higher and profitability will be even more difficult.

But don’t panic. In short, some fees went up and some fees went down, and the overall impact on profitability was modest. Mid-to-low volume sellers actually saw carrier fees decrease 31%, while overall costs were up a modest 16%. For these sellers, the majority of the change is coming from inbound placement fees – the newly introduced charge.

To ensure that brands aren’t in the red, there are ways to optimize carrier strategies in order to find the sweet spot. That will likely look like using a combination of Amazon’s own carriers as well as external carriers. Brands also have the option to ship to customers themselves, but that’s not always more cost-effective.

There are also some benefits for business in exchange for the steeper fees. The customer gets a better experience, thanks to an upgraded, faster, and more efficient FBA model. Additionally, more efficient management of orders means fewer dropped or late shipments for customers. Customer experience is part of Amazon’s Flywheel strategy and a major factor impacting sales in the marketplace.

In December 2023, Amazon addressed the fee changes and their impact on sellers, writing that sellers would see an average increase of 15 cents in fees per unit sold, but adding that some may actually see a decrease in fees. Profitability remained steady for the brands that Acadia analyzed. We observed month-over-month profitability change starting with January 2024 and concluded that – apart from minor typical and expected fluctuations – there is no negative impact on the overall profitability of the accounts we analyzed. Margins have also generally stayed the same.

That said, costs are again going up in Q4, with storage fees expected to go up again starting October 1. That could be offset by higher volume and faster inventory turns prompted by the holiday season.

The Bottom Line

As always when it comes to doing business on Amazon, diligence pays off. Check your math: while increased inbound fees may seem eye-popping, offsets from reduced fulfillment fees may mean there’s not a massive overall change.

Be proactive as well. If your inbound fees seem untenable, spend time ensuring that you’re optimizing your strategy and recognize that there is no one-size-fits-all approach for shipping to FBA. Each seller should experiment with different shipment splits, considering variables such as product dimensions, weights, case pack sizes, and shipping destinations. Testing different configurations can help identify the most cost-effective methods for your specific products. For some Acadia accounts, using the minimal shipment split showed as the most cost-effective option for both SPD and LTL shipments. Using this method, sellers are avoiding a high carrier cost and instead are paying Amazon for inbound placement fees per unit which, when summed up, are way less than what the carrier would charge to split those shipments to multiple locations.

Utilize test shipments to preview shipping costs before determining your actual shipping option. You have the option to cancel shipments after you create them, allowing you to avoid the shipping charges. For SPDs, you need to cancel your shipment within 24hrs and for LTL you need to be much faster and cancel within an hour of creating the shipment. Continue to refine your shipment strategy based on the insights gained from your test shipments and find a "sweet spot" where costs are minimized.

It also helps to remember the type of shipping and fulfillment behavior that Amazon likes and rewards. Grouping items to meet the five-carton shipping requirement and using optimized shipping splits can save money, as well as sending larger shipments less frequently that can be sent across Amazon warehouses.

By following these recommendations, sellers can effectively navigate the complexities of FBA shipping and improve their operational efficiency.

Also, know the tips and tricks of what Amazon offers to save costs. Amazon’s FBA New Selection program exempts some new products from fees for a set period. Amazon’s Ships in Product Packaging (SIPP) is another program that can cut costs, offering incentives for sellers to have ready-to-ship packages that don’t need Amazon boxes. Another way to save cost would be analyzing whether your products could belong to a lower tier that has lower fees (e.g. shrinking your packaging in case your dimensional weight is determining the current fee or losing that extra ounce of packaging material that’s putting your product in a higher-priced size tier).

The fee changes, while seemingly foreboding, shouldn’t make a big impact on your bottom line as a seller. With enough massaging and strategizing, you should be able to maintain profit margins while customers benefit from better and faster shipping. Do bear in mind - Amazon will keep introducing changes and their fee structure will always evolve so making sure you’re ahead of Amazon is key. As soon as Amazon announces changes, analyze the impact of those changes on your business and determine the next steps before the changes take effect.