CPG brands have been blown away by the rise of Instacart since Covid hit. There’s an urgent desire for more information about how to approach Instacart from a strategic perspective.

Bobsled CEO Kiri Masters has been speaking both with brands that actively use Instacart’s marketing tools, and the Instacart team directly. We’ve compiled her key insights below. Read on to learn more!

What Is Instacart?

Instacart is an online ordering solution for grocery shoppers. Users create an Instacart account, order groceries from local stores either via desktop or their mobile device, an Intsacart ‘picker’ assembles the order, and then Instacart facilitates a home delivery or an in-store pickup.

“The major advantage of Instacart is that it taps into a shopper’s existing brick-and-mortar retail preferences,” Kiri says. “Shoppers know exactly what items their local stores typically tend to stock, and Instacart makes the acquisition of these tried-and-tested items easy. On the other hand, with online grocery delivery from Amazon or Walmart, shoppers may need to take a chance on certain brands or products they’re unfamiliar with, or maybe their desired items are not available, and this creates friction.”

How Big Is Instacart Versus Other Channels?

“Instacart’s growth since Covid hit has been staggering,” Kiri explains. “They’ve taken market share directly from Walmart and Amazon, according to data from analytics provider Second Measure.”

National Online Grocery Market Share

- Pre-Covid, Instacart owned 29% of all online grocery orders. Walmart was previously the biggest player, owning 46%

- Post-Covid, Instacart is now the biggest player, owning 56% of all online grocery orders. Walmart is now down to 22% market share

National Online Grocery Market Share (Delivery Only)

- Pre-Covid, Instacart facilitated the most online grocery delivery orders, owning 45% of market share. Amazon was in second place, owning 29%

- Post-Covid, the gulf has widened considerably. Instacart now owns a massive 71% of all online grocery delivery orders. Amazon is still in second place, but is down to 12%

Why Has Instacart Grown So Much (At The Expense of Amazon & Walmart)?

Because of Instacart’s network size, they’re perfectly poised to capitalize on shifting consumer preferences. To give you some context, Walmart has 4,200 stores. Instacart works with 400 retailers with a total of 30,000 stores!

This means that at any given time, Instacart is running 30,000 advertising auctions at the store level. There are obviously geographical limitations on what customers can order through Instacart. However, it’s very difficult even for companies the size of Walmart and Amazon to compete logistically with Instacart’s breadth of selection.

The Amazon and Walmart model necessitates items being available within their own networks. By leveraging a huge number of brick and mortar retailers, Instacart is often better placed to give grocery shoppers exactly what they want at any given moment, and this is why they’ve won so much market share since Covid hit.

Bobsled will be releasing a new report about Amazon Fresh soon!

To get a copy the moment it drops, sign up to our newsletter below.

What Are The Instacart Opportunities & Challenges?

“Any food or CPG brand, and many health and personal care brands, should be paying very close attention to Instacart,” Kiri says.

On the plus side, there are some basic tools that can help brands grow sales on the channel. Conversely, due to the nature of the platform, there are several data-related headaches.

|

OPPORTUNITIES

|

CHALLENGES

|

What Does The Future Hold For Instacart?

As the channel matures, Kiri predicts three key changes. By learning more about the platform now, brands will be better placed to roll with the punches. Find these data-based predictions below.

Prediction #1 – More Shoppers Will Choose To Buy Groceries Online, Favoring Instacart

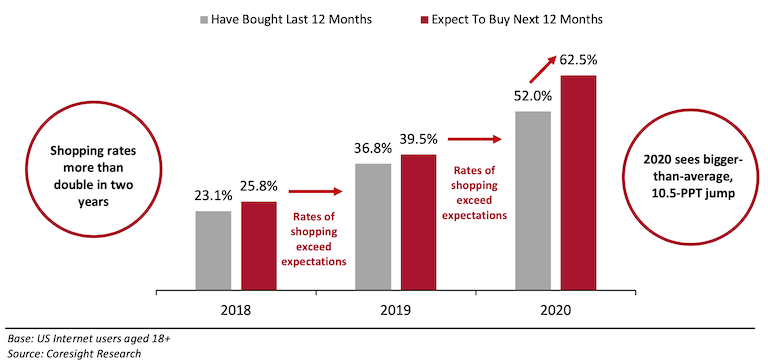

Coresight Research reports that a greater number of shoppers expect to buy groceries online over the next 12 months.

Source: Coresight Research

“The takeaway for brands here is that not only is Instacart’s slice of the pie growing – the total market is growing too,” Kiri says. “Considering Instacart is the number one channel in the online grocery space, it would be silly not to make channel optimization a huge priority.”

Prediction #2 – Instacart Advertising Will Become More Crowded

Brands are reporting very good ROAS on Instacart right now, according to the channel managers that Kiri has spoken with that are actively using Instacart’s self-serve solution. “Some are reporting results 3-5X higher compared to Amazon,” Kiri says. “This is due to the lack of competition on the channel, meaning low CPCs.”

Instacart also has an aggressive advertising development roadmap. They transitioned to a 2nd price auction model in the second week of June and have a lot of data and functionality features to ship. CPCs will increase as more advertising volume starts to pour into the channel.

It’s important to note that Instacart advertising is limited to your inventory distribution. For example, if your products are only in 30 stores, you can only advertise based on those search terms in specific locations. This is compared to Amazon where there’s no inventory distribution limits on advertising.

Instacart shares projected CTR data with brands. The more you spend on Instacart advertising, the more data you get, regardless of the size of the company.

Learn more about Winning Grocery & Gourmet

PPC Strategies On Amazon

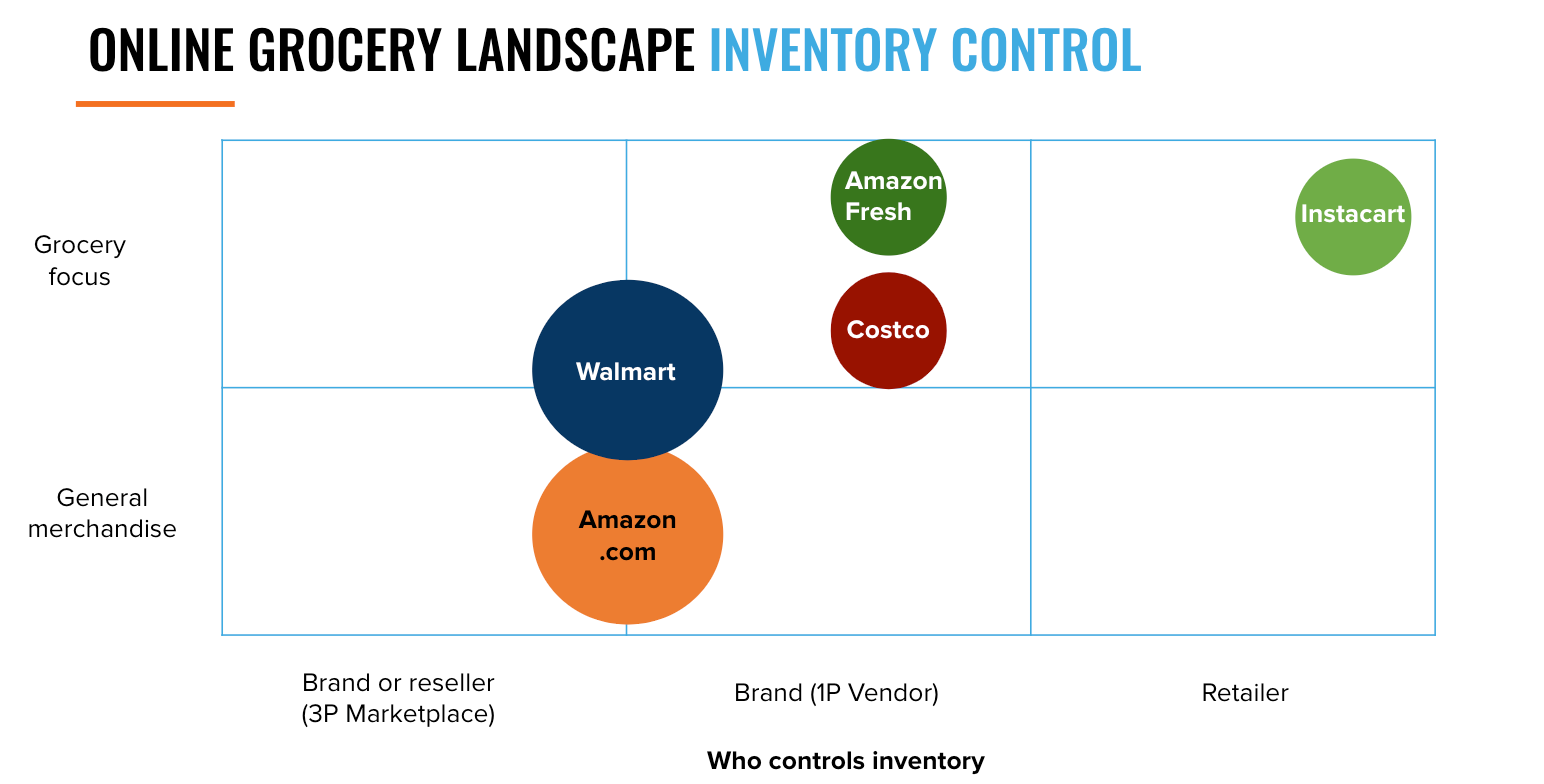

Prediction # 3- Brands With The Best Inventory Control Will Win Big

“Instacart is yet another piece in the fragmented retail landscape,” Kiri says. “Brands need to meet target shoppers wherever they happen to be. And they need to do everything from an operational, marketing and advertising perspective to profitably turn target shoppers into customers, or even better, loyal repeat customers.”

This is no easy feat! The first step is identifying the fundamental differences between each channel.

Above: Bobsled’s Online Grocery Inventory Control Analysis

With online grocery, brands may only get one shot to win themselves a new customer, and this makes intelligent inventory management across channels an absolute necessity.

How Should Brands Be Managing Instacart Now?

“Ignore Instacart at your peril,” says Kiri. “We’ve identified four steps brands should be taking at this moment in time.”

- Understand The Opportunity. What percentage of your target shoppers are currently using Instacart vs other channels?

- Get Clear On Internal Management & Reporting. Within a brand’s P&L, sales from Instacart are often attributed to brick & mortar channels, but digital teams typically run campaigns. There may be confusion about who is ultimately responsible for the channel.

- Speak With Willing Retail Partners About Instacart Sales Volume. Instacart will give you total SKU level sales data (if you’re a big enough brand). However, you will never get a retailer by retailer sales breakdown from Instacart. Certain retail partners may be willing to share the ratio of your products sold on Instacart. This data would be invaluable for inventory planning purposes.

- Start Advertising. The Instacart ad platform is destined to become more crowded – get in early and learn the ropes whilst CPCs are low!

NEED HELP TODAY?

Bobsled has access to the beta Instacart API through our ad tech provider and can help manage your advertising efforts on the channel! Book a free consultation below.

{{cta(‘9b801dcc-91fa-4ab8-a3e5-fdd1109f7b34’)}}