Kiri Masters is the Head of Retail Strategy at Acadia.

Amazon wants to be the everything store, and while that path is paved with the hundreds of thousands of small to medium sized brands that make up Amazon’s business, it’s not exactly in the company’s interest to put those SMEs front and center.

You can get the sense of how this is working when watching an influencer video. These creators will point audiences to their Amazon storefronts to buy what they’re promoting, or say they purchased an item from Amazon. It’s often not “X brand” on Amazon – unless you have enough recognition that your own brand name eclipses Amazon’s, and that’s reserved to a select few players (Coke, Dyson, Apple).

This has long been a reality of selling on Amazon, but a handful of new features that Amazon appears to be testing are putting small brands even further out of the spotlight, giving them less visibility in key moments like searches. Regardless of what Amazon’s intentions are, this makes it harder for small brands to stand out – especially new ones with less tenure on the site.

At Acadia, our job is to help brands succeed on Amazon, and that means strategizing around the tactical changes the company is bound to make with macro goals like sales volume and customer experience in mind. There’s always a way to advantage your brand over the competition, with a bit of work and insider knowledge.

First, let’s unpack the changes Amazon has made.

1. Removing brand names from search results

As of recently, Amazon has been removing brand names from product titles as they appear in search results. Brands strategically name their products to include the brand name so that recognition will build and customers who do know the brand can spot it out of the sea of other results. But in search, these same products are popping up with all the information but the name showing up. This seems to be Amazon’s move to pull brand name out of consideration for customers when shopping for a generic product or category – if customers search for a brand by name, the name will appear in the results. You can see how this gives bigger brands the upper hand.

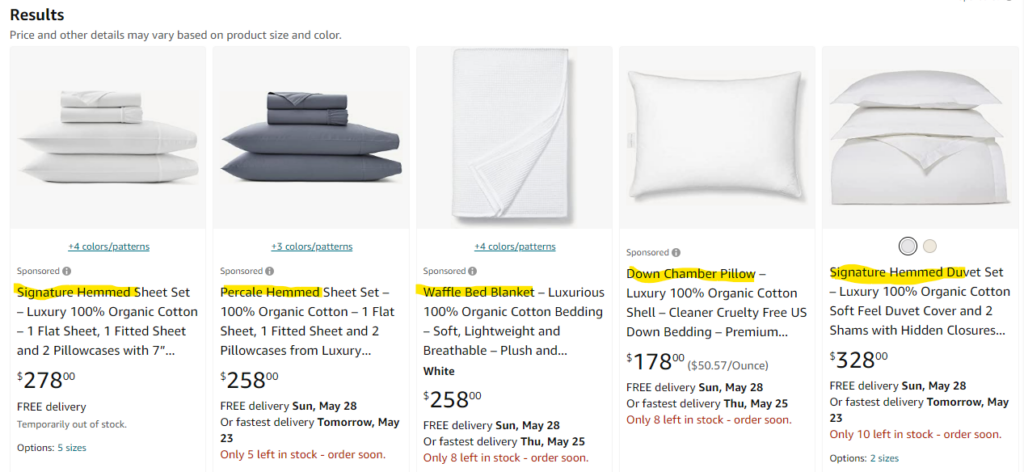

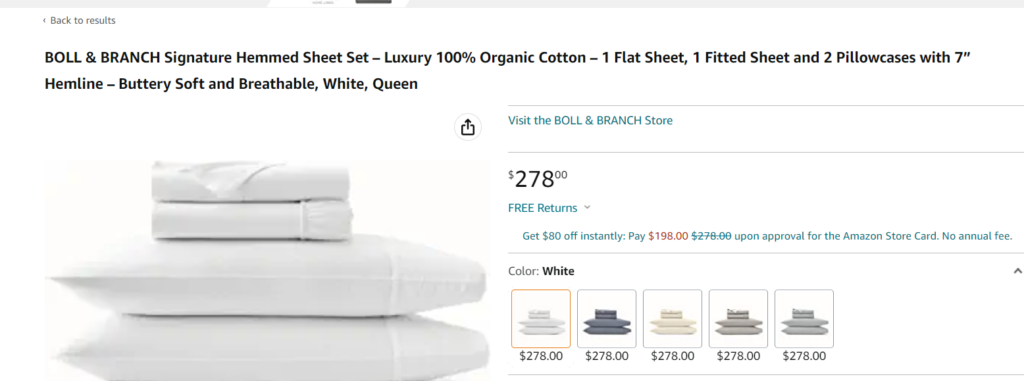

A search for white sheets shows product results without the brand name in the title (image 1), although in clicking through to the product detail page (image 2), the brand name is included in the title.

What’s the motive?

Here, Amazon seems to be manipulating search results to further reinforce its own brand dominance, even when people aren’t shopping for Amazon-branded items. Think again of how an influencer will tell her followers she bought something on Amazon – Amazon seems to be leaning into that.

But above all, Amazon values volume. Small brands drive volume, but not one or a few small brands – all of them together. Consider the customer’s experience. Unless Amazon data recognizes a pattern in brand search volume – meaning people are searching for a specific brand out of recognition and intention – then they’re not incentivized to put the brand name front and center when customers are searching.

Amazon’s vast sea of sellers and products can easily amount to information overload for customers who are already navigating reviews, descriptions, Best Seller tags and more when they select a product. The brand name is less important than the product specs, Amazon has determined.

So what can I do about it?

Fight for your space in search results by flexing your ad spend, and placing it wisely. Sponsored brand ads and sponsored product ads can both work to get more visibility in search results. Video ads in particular give brands the chance to show off their logo and drive awareness without Amazon’s manipulation.

For more ways to make your brand stand out on Amazon, visit Acadia’s swipe file, which breaks down all of the content types, how they show up on Amazon and how brands with smaller budgets can make it work to their advantage.

2. Adding weekly sales and views to product pages

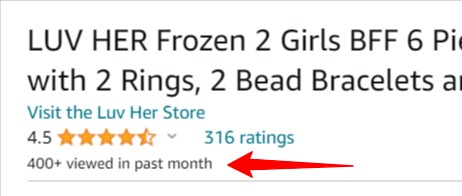

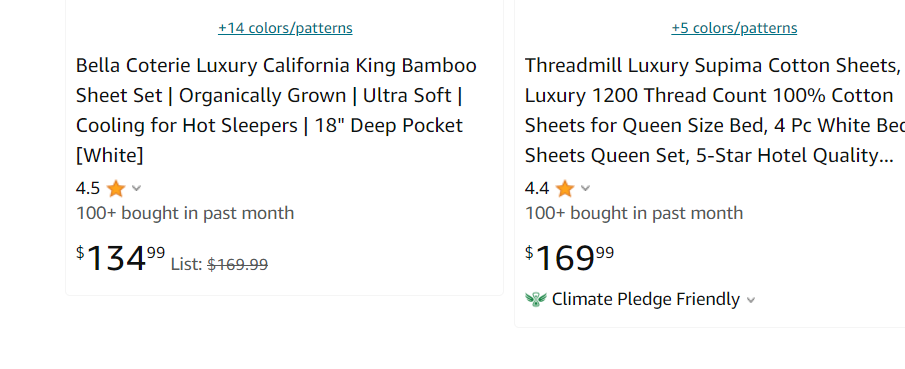

Another new Amazon feature that’s rolled out recently are weekly sales and view figures displayed on product pages. These can be found underneath the average star count, just below the product title. A small brand’s product might show “50+ bought in the past week”, a more established brand might see “300+ bought in the past week”. Same goes for view counts, which Amazon appears to be testing as well.

But what if your brand is just getting started and doesn’t have many sales yet to show for it? You could see how a customer might quickly see few to no purchases in the past week and quickly bounce out of the page to find more tried-and-true options.

Amazon search results now show the volume of purchases in the past month, which may benefit larger, more established brands.

What’s the motive?

It goes back to improving the customer experience in order to drive sales volume. Customers are more likely to purchase a product that has lots of other customers – it means the product is preferred by other people. That kind of validation matters on Amazon, when customers are inundated with choices. Amazon also rewards brands that have repeat purchasers and tenure on the platform. If you don’t have it, that’s your problem, not Amazon’s.

Social proof of a product, meaning other people are vouching for it virtually with their sales and view counts, helps drive sales. There’s also another reason potentially at play and that’s a new competitor on the field: Temu, the ultra-fast, ultra-cheap Amazon rival from China offers this feature, and Amazon doesn’t want to seed any space to the competition.

So what can I do?

Ads can help boost preferential listing, but don’t get too reliant on ad dollars to gain views – paid-for spots don’t work as well for customers as social proof. Lean on customer reviews and testimonials that can help build credibility for small brands.

For brands thinking about diving into Amazon, now is the time to perfect your launch strategy. Optimizing your operations and inventory and driving external traffic to Amazon right out of the gates can boost a brand’s “honeymoon” period on the marketplace and help get the flywheel spinning for future success. A slow start can mean bad news. Also be intentional in your ad strategy: using creative features that push the product benefit hard can help customers look past other metrics that might be lacking, like number of purchases.

Once metrics start adding up, these sales or view counts can help brands get even more visibility by earning higher placement in Amazon search results, so the flywheel will start working.

Final thoughts

At the end of the day, Amazon does need the small brands that make up its business – they are the thousands of bricks that build the house. It’s not that they don’t care about them, they’re just not the main focus. It’s crucial for brands to stay on top of these changes that Amazon is making and try to follow the motives – customer experience and volume – to make the platform work for them. Acadia can help you stay on top of Amazon’s changes, and navigate them with confidence.